Return on Capital Employed (ROCE) is a foundational metric in finance, often used by investors, analysts, and corporate leaders to evaluate how effectively a company is deploying its capital to generate profits. It serves as a litmus test for operational efficiency and long-term value creation. In this guide, we’ll explore what ROCE is, how it’s calculated, how it compares to similar metrics like ROIC and ROE, and why it matters so much for investor decision-making.

What Is Return on Capital Employed (ROCE)?

Return on Capital Employed (ROCE) is a financial metric that measures the return a company generates from its total capital employed, which includes both debt and shareholder equity. It indicates how well a business is using all sources of financing to generate operating income.

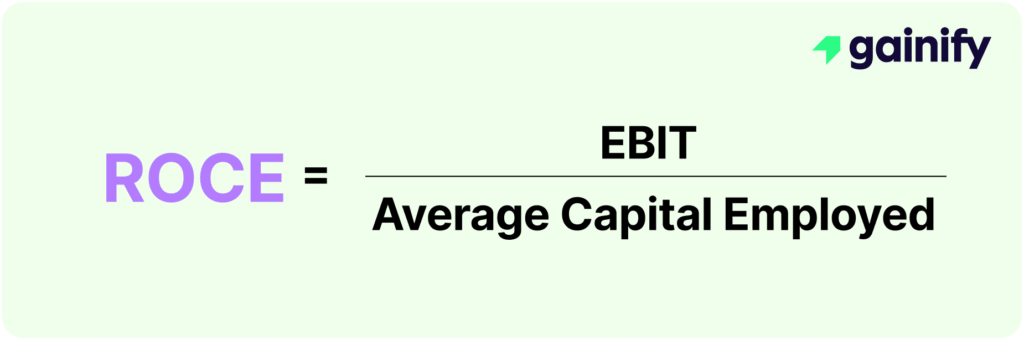

Formula for Return on Capital Employed

Where:

EBIT (Earnings Before Interest and Taxes):

EBIT represents a company’s core operating profit. It’s the profit a company generates from its operations before accounting for interest payments and income taxes. EBIT (operating profit) excludes non-operating income/expenses and provides a cleaner view of the firm’s ability to generate profit from its actual business activities.

Capital Employed:

This is the total amount of capital that has been invested into a business to generate profits. There are two common ways to calculate capital employed from the balance sheet metrics:

- Capital Employed = Total Assets – Current Liabilities

- This measures the long-term capital used by the business.

- It excludes short-term liabilities like accounts payable or short-term debt, focusing instead on assets that support long-term growth.

- This measures the long-term capital used by the business.

- Capital Employed = Total Equity + Total Debt

- This reflects the total funds invested by both shareholders and creditors.

- It emphasizes how much permanent capital is tied up in the business.

- This reflects the total funds invested by both shareholders and creditors.

Why ROCE Matters?

ROCE = How Efficiently a Company Turns Capital Into Profit

Unlike metrics that only focus on equity (like ROE) or total returns (like ROIC), Return on Capital Employed zeroes in on how well a company is using its invested long-term capital to generate operating profit.

A high ROCE indicates:

- Strong operational efficiency.

- Effective use of both debt and equity capital.

- A potential for value creation without necessarily growing asset base or leverage.

A low ROCE may suggest:

- Inefficiency in operations or capital allocation.

- Underutilized assets or poor investment decisions.

Investor Insight: ROCE helps investors understand how well management is using the capital at its disposal. It’s especially relevant when comparing capital-intensive industries like manufacturing or utilities versus asset-light businesses like software.

ROCE vs. ROIC vs. ROE: What’s the Difference?

While ROCE is powerful on its own, it’s often compared to two other popular metrics: ROIC and ROE. Each serves a specific purpose and provides different insights depending on the context.

Return on Invested Capital (ROIC)

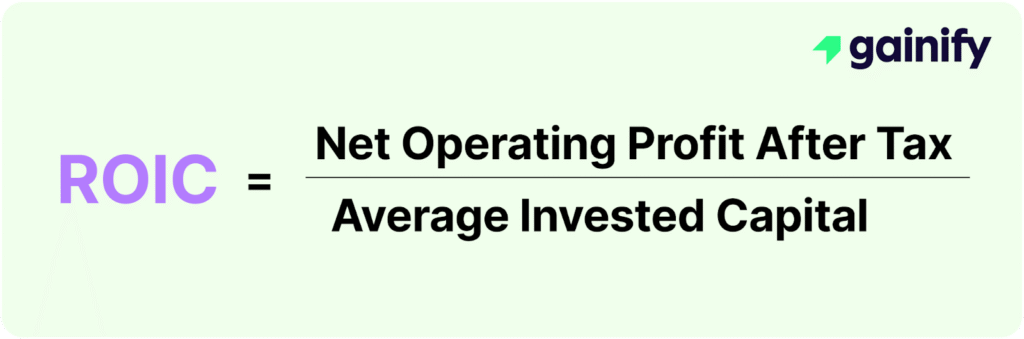

Formula for Return on Invested Capital:

Where:

NOPAT (Net Operating Profit After Tax): This is the profit from core business operations after a specific tax rate is applied, excluding the impact of interest expenses. It gives a cleaner picture of operational efficiency by removing distortions caused by capital structure, but it is not a cash-flow metric.

Invested Capital: Represents the capital actually invested in operations. Calculated as: Invested Capital = Debt + Equity – Non-operating Assets. This formula excludes idle or non-operational assets (like excess cash or passive investments), focusing only on the capital used to run the business. This information is taken from financial statements.

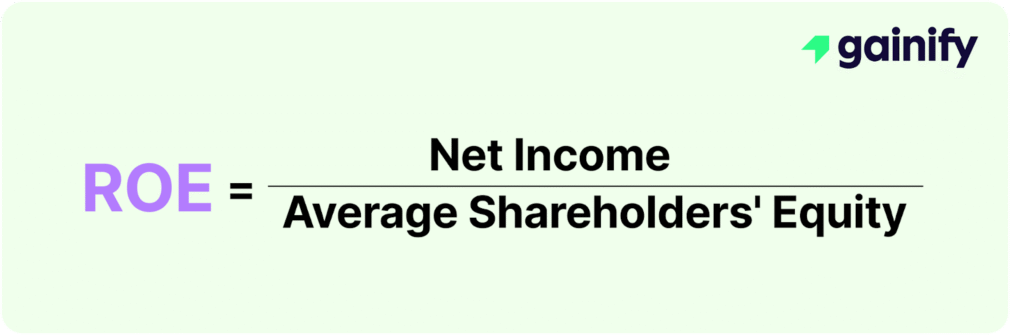

Return on Equity (ROE)

Formula for Return on Equity

ROE focuses exclusively on the return generated on the shareholders’ equity portion of a company’s capital. It reflects the company’s ability to generate net income (after interest and tax) from the capital that equity holders have invested. While useful, ROE does not account for the company’s debt burden or how other forms of capital contribute to profitability. It’s often elevated by higher leverage, which can artificially boost performance. Therefore, it is crucial to interpret ROE alongside other return metrics, particularly when evaluating capital-intensive or highly leveraged firms.

Comparison Table

| Feature | ROCE | ROIC | ROE |

| Profit Measure | EBIT (Pre-Tax) | NOPAT After-Tax (Net Operating Profit After Tax) | Net Income (After Interest & Tax) |

| Capital Base | Total Assets – Current Liabilities | Invested Capital (Operating Assets) | Shareholders’ Equity |

| Capital Type | Debt + Equity | Operating Debt + Equity | Shareholder Equity Only |

| Tax Adjustment | No | Yes | Yes |

| Focus | Operational efficiency | Value creation vs Weighted Average Cost of Capital | Shareholder returns |

How ROCE Informs Investor Decisions

1. Screening for High-Quality Businesses

Investors often screen for companies with high and consistent ROCE figures, as these companies demonstrate strong operational efficiency and sound management. A company with a robust ROCE that exceeds its industry average suggests a durable competitive advantage and effective deployment of resources.

2. Assessing Capital Allocation Decisions

ROCE helps both investors and corporate decision-makers assess whether capital is being used wisely. If ROCE consistently falls below the company’s weighted average cost of capital (WACC), it signals that the business may be destroying value, suggesting the need to reassess capital expenditures or strategic investments.

3. Sector Benchmarking and Strategic Comparison

Since capital requirements vary across sectors, ROCE is particularly useful for benchmarking companies within capital-intensive industries like energy, telecom, or manufacturing. Comparing ROCE across peers offers insights into which firms are better at converting capital into profit, independent of size or market share.

Final Thoughts

Return on Capital Employed (ROCE) is more than just a financial ratio — it’s a critical lens through which investors and analysts assess how efficiently a company converts capital into profit. In a landscape where capital allocation defines long-term competitiveness, ROCE offers a holistic, debt-inclusive measure of performance that cuts through accounting noise.

When paired with complementary metrics like ROIC and ROE, ROCE allows for a layered understanding of profitability:

- ROCE emphasizes operational efficiency across all capital.

- ROIC zooms in on returns from core invested assets.

- ROE focuses on equity-driven returns for shareholders.

Together, they form a comprehensive toolkit for comparing companies across sectors, evaluating capital allocation strategies, and identifying high-quality, high-return businesses. For investors seeking long-term value and management discipline, ROCE isn’t just useful — it’s essential.