Alpha Spread is built to empower value investors. The platform’s primary focus is to help you uncover a stock’s true intrinsic value, providing valuation estimates and ranges. Valuation itself is calculated using the average of DCF Valuation and Relative Valuation. The Bull & Bear case analysis gives you further information needed to compare contradicting viewpoints on a stock, and put valuation ranges in context.

Built in screeners enable you to quickly identify stocks worth investing in. Identify stocks that meet key value investing criteria such as “sensibly priced quality”, “significantly undervalued”, “magic formula”, and “high growth”. If pre-built screeners do not fit your needs, you can also create customized screeners.

Once you’ve identified a stock you want to research in more detail, Alpha Spread’s individual stock analysis page provides you with key fundamentals, economic moat analysis, earning call summaries, and more.

Notably, Alpha Spread’s AI assistant is adept at detailed stock analysis, helping you speed up research and make more informed investment decisions.

To bring this all together, Alpha Spread offers an investment journal feature. Use it to document your investment thesis, and track decision outcomes.

You will find the pricing is accessible for retail investors, with plans beginning at just $12 per month.

However Alpha Spread does have some limitations. Very importantly, Alpha Spread does not state their data source. This means you cannot be sure that you’re getting the latest, best, or most up to date information about a stock. Trading based on old or irrelevant information is risky, so you would be wise to compare Alpha Spread alternatives like Gainify or TIKR that provide stock data from a trusted & reliable source.

Additionally, while you will find Alpha Spread’s stock coverage goes beyond the US, the company does not provide information about how many stocks or global exchanges are covered. Other platforms like Gainify, TIKR, and Simply Wall St. are much more explicit about how many stocks and global exchanges you will have access to.

Lastly, while a free plan and relatively accessible paid plans are available, the number of stocks you can actually research is quite limited (3-15 per week) – unless you’re on the Premium unlimited plan.

There are many alternative stock research tools available to retail investors today. Many provide features that rival enterprise-tier tools. Alpha Spread focuses solely on value investing, and while this gives the platform clear focus, it does result in the absence of key features.

Other platforms, such as Gainify, provide all the tools you need to uncover intrinsic value along with stock screening, top investor tracking, Congress insider trades, trending stocks, dividend information and industry comparisons, and more.

In this article we will compare and contrast Alpha Spread against top stock research platforms for retail investors, including: Gainify, Simply Wall St, Koyfin, GuruFocus, and Yahoo Finance.

Continue reading to find the platform that best suits your investment style, research preferences, and budget.

Alternative 1: Gainify.io — Best for AI Stock Analysis and Valuation

Gainnify is the most compelling choice for retail investors who want access to real-time Wall Street data, AI stock analysis capabilities, top investor tracking, and both pre-built & customized screeners.

Of all the platforms in this comparison, Gainify has the most comprehensive feature set. You will find it intuitive and user friendly, with clear well-defined dashboards and clean easy to interpret visualizations.

Key features include:

- AI stock analysis tools

- Top investor and Congress insider tracking

- Both pre-built and customizable stock screeners

- Proprietary metrics not found elsewhere to predict future value

- The world’s largest database of analyst estimates available to retail investors

AI stock analysis

Gainify’s AI chatbot assistant can answer all your most important stock analysis questions. It’s a great way to speed up research and cover more stocks, so you can be sure you’re investing in the right companies – not just the ones you had time to research manually. It’s connected to real-time Wall Street data from S&P global intelligence for insights and information you can trust.

Ask Gainify AI questions like:

- Which companies in the US banking industry offer the best dividend yields?

- Who are the semiconductor industry’s top players?

- What is Gainify’s view on NVIDIA?

- What insights can we gain from Apple’s latest earnings call?

Gainify’s AI stock analysis is available to all users – even those on the free tier. Create an account now and test it yourself.

You will also find earnings call summaries built into each individual stock analysis page. Whether you’re researching Palantir or Paypal, Gainify provides you with a quick summary of earnings call insights so you can stay up to date with the inner workings of the companies you’re researching. Key value drivers are highlighted so you never miss the most important information.

Largest database of analyst estimates for retail investors

One huge advantage of using Gainify is that you get access to S&P Global Intelligence data. This includes the world’s largest database of analyst-verified valuations available to retail investors today. You’ll operate with the same information and insights that Wall Street pros rely on.

Gainify has built a number of helpful charts and graphs on top of this vital analyst estimate data. One quick glance at Gainify’s “Estimates” chart provides a complete history of how estimates have evolved over time, and analyst’s forward predictions.

Historical evolution and forecasts are available for:

- EPS

- EBIT

- CAPEX

- EBITDA

- Revenue

- Net Income

- Op. Cash Flow

- Dividend / Share

- Cash Flow / Share

- Book Value / Share

Top investor tracking

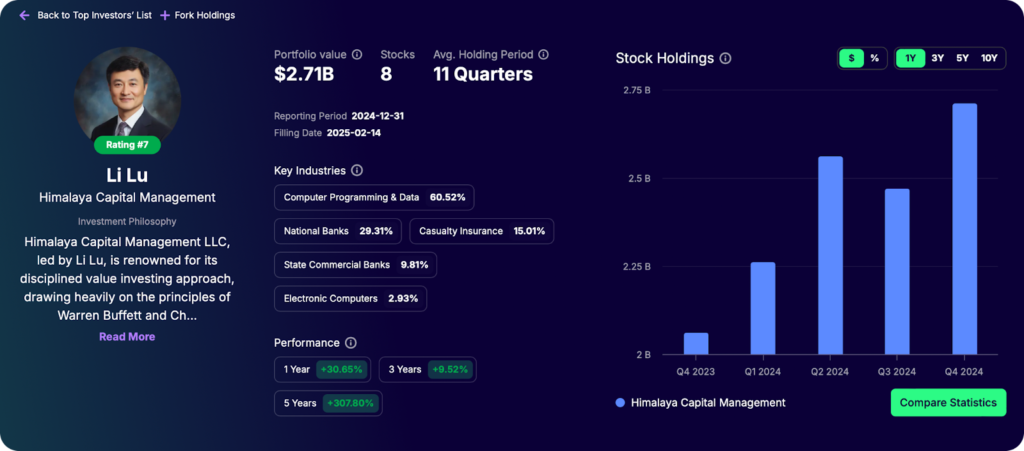

If you find yourself wondering what top investors are buying now, or how you can replicate the success of Congress insiders, Gainify has what you need. Top investor tracking enables you to compare the portfolios of pros against one another and fork top portfolios to your own watchlist.

Follow the likes of Leon Cooperman (Omega Advisors), Stephen Mandel (Lone Pine Capital), David Tepper (Appaloosa Management), Warren Buffet (Berkshire Hathaway), and more.

You’ll uncover portfolio value, number of stocks held, industry allocation, 1-5 year performance, and new buys or sells. Replicating what top investors are buying or uncovering which stocks to look into in more detail can help you build a winning portfolio of your own.

Trending stock tracking shows you what Congress insiders are buying and selling right now, providing you with essential clues to kickstart your stock research process.

Stock screening

Utilize Gainify’s pre-built stock screeners in the “Ideas” section or build your own custom screeners – the choice is yours.

Pre-built stock ideas screeners filter for top stocks in the semiconductor, AI, quantum computing, space exploration, nuclear energy, cyber security, and 3D printing industries. You’ll also find screener groups that show stocks currently meeting key value investing and key fundamental criteria, including:

- Cash cows

- Pivot year stocks

- Dividend champions

- Highest Gainify rating

- Highest analyst rating

- Valuation opportunities

- Strong past performance

- Attractive high growth companies

When it comes to building your own custom stock screeners, you will be able to combine any number of filters across global regions & exchanges, 150+ industries, and 370+ key financial metrics and indicators. This truly powerful stock screening solution enables you to quickly find stocks to invest in, no matter how broad or specific your investment strategy.

Proprietary metrics

Gainify’s proprietary metrics (composites of tried-and-tested valuation methods that focus on predicting future value) are a real advantage for your stock research process.

You’ll have access to unprecedented insight into:

- Performance: Management’s consistency in delivering growth and shareholder value.

- Momentum: A stock’s current market strength and potential future performance.

- Valuation: Whether a stock is undervalued, fairly priced, or overvalued in comparison to both its historical valuation and market benchmarks.

- Outlook: A stock’s expected financial trajectory relative to both industry peers and the broader market.

- Health: Shows a stock’s ability to weather economic downturns and continue meeting its long-term obligations.

Advantages

Gainify provides the broadest feature coverage of any platform in this comparison, at the most accessible price point.

✅ Watchlists

✅ Proprietary metrics

✅ Intrinsic value focus

✅ AI chatbot for stock analysis

✅ Visual interface and modern design

✅ Top investor and Congress tracking

✅ S&P Global Intelligence data source

✅ S&P Global Intelligence stock market data

✅ Free tier with access to all premium features

✅ 3 year forward projections for key analyst estimates

✅ 15 year history of analyst estimates and their development

Limitations

Gainify has the best feature coverage of any platform in this analysis. But it does not focus on technical analysis, or provide access to the largest number of exchanges or stocks.

❌ No excel integration

❌ No broker integration

❌ No investment journaling

❌ Less stocks and exchanges than other platforms

Pricing

Amongst stock research platforms Gainify, with its comprehensive feature set and accessible pricing, is the best value for money option you will find.

Starter (Free): Includes all core features with 10 AI queries per month, 1 year of analyst estimates, and 1 year of forward valuation multiple data. No credit card required.

Investor ($10.99/month or $7.99/month billed annually): Includes the Gainify Rating, 50 AI queries per month, 3 years of analyst estimates, 10 years of forward valuation data, and priority support.

Alternative 2: Simply Wall St — Best for Visual Analysis

Simply Wall St is a top stock research platform for visual analysis – it’s flagship ‘Snowflake’ analysis leads the way in simplifying complex stock information. Global coverage of over 120,000 stocks is another strong advantage, giving you comprehensive access to almost any market.

With brokerage sync, you’ll also be able to get up to date information on how stocks in your portfolio are performing, and expected to perform. This is a strong advantage over Alpha Spread, which currently lacks such functionality.

Another feature you won’t find in Alpha Spread is Simply Wall St’s management profiles – showing you management’s compensation, tenure, share ownership, and more.

If analyzing financial statements is valuable in your research process, Simply Wall St. makes this easy. No need to parse through large amounts of text and data tables – the platform provides crisp data visualizations for income statements, balance sheets, and cash flows.

Advantages

✅ Broad global stock coverage

✅ Intuitive visual interface

✅ Broker integration

Limitations

❌ No AI capabilities

❌ Annual only subscription model

❌ Limited number of stock screeners available (even on top paid tiers)

Pricing

On the free tier you have access to 5 reports/month, 1 portfolio, and 10 holdings. Paid plans cost up to $119.88/year (provides unlimited access to most features).

Alternative 3: Koyfin — Best for Multi-Asset Class Analysis

Koyfin boasts a terminal style interface, seemingly attempting to replicate the look and feel of enterprise tier options. Not quite as simplified as Alpha Spread’s UI, it does have a steeper learning curve.

One major advantage Koyfin has over alternatives is its multi-asset coverage. You will be able to go beyond researching just stocks, and gain insights into bonds, ETFs, commodities, and currencies.

In comparison to Alpha Spread, Koyfin appeals to a slightly more sophisticated audience – providing features that cater to not only retail investors, but also to professional investors and financial advisors.

You’ll also have access to broad economic indicators – to analyze not only individual stocks, but also broad market trends.

Lastly, if you’re a financial advisor or in a role that requires you to manage client portfolios – Koyfin is the only platform in this comparison that has client portfolio management and reporting features, including a Schwab integration.

Advantages

✅ Broad asset class coverage

✅ Customizable charting tools

✅ Macro economic analysis

✅ Client portfolio analysis

Limitations

❌ Higher pricing

❌ Steeper learning curve

❌ Less pre-built tools and quick insights

❌ Uncovering insights requires more work from you

❌ Higher pricing in comparison to other stock research tools

Pricing

Koyfin’s free tier is quite limited so you’ll only be able to access S&P 500 data. But if you opt for a paid plan, you’ll unlock global stock data, full US ETF holdings (as opposed to only the top 20), and deeper actual versus analyst estimate data.

Paid plans range from $49–$199 per month.

Alternative 4: GuruFocus — Best for Value Investing Focus

Like Alpha Spread, GuruFocus also appeals to value-focused retail investors. But GuruFocus packs an added punch when it comes to breadth of features. It has almost everything you need for stock research (apart from technical analysis tools – which Alpha Spread also does not provide). You’ll be able to power your stock research with US & global macro economic data, curated stock news, insider and politician trade tracking, stock screeners, an AI stock analysis assistant, and more.

Alpha Spread, in comparison – does not provide quite the same breadth or depth of features. Especially when it comes to stock screeners.

Unfortunately, while GuruFocus boasts a range of features, the platform’s UI is incredibly overwhelming and complex. You may struggle to 1) Gain insights in the first place as screeners can be overwhelming and take a lot of time to construct 2) Parse the large amounts of text data provided in the platform.

Advantages

✅ Excel add-in for custom analysis

✅ 30 years of historical data

✅ Guru portfolio tracking

✅ AI analysis

Limitations

❌ Complex interface with steeper learning curve

❌ Expensive (the most expensive platform in this analysis by far)

❌ You need to pay extra to get access to global data (additional cost per region)

Pricing

While you can explore the platform without signing up or paying for a subscription, paid plans are prohibitively expensive for retail investors, ranging from $499 (US data only) to $5120 (global data) per year.

Alternative 5: Yahoo Finance — Best for Stock News

Many readers may know Yahoo Finance as a financial and stock news website. It certainly does fulfill this role very well. You will find up to date news across stocks, options, ETFs, mutual funds, crypto, and more.

In contrast to other stock analysis tools in this comparison, you will find some technical analysis capabilities (and even alerts for when a stock meets technical analysis criteria) in the top-tier $49.95/month plan.

If you’re seeking deep historical data, Yahoo Finance delivers better than most other stock research platforms. You’ll find up to 40 years worth of historical income statements, balance sheets, cash flow reports, and earnings data.

However, while it has paid plans with some pro-tier features (technical analysis, insider trade tracking, and analyst ratings), Yahoo finance does appeal mostly to those wishing to stay generally informed about the economy and stock market. If you’re a more active retail investor then it may not cover all your stock research needs.

Advantages

✅ Technical charting capabilities (unique among platforms in this comparison)

✅ Multi-asset coverage including crypto

✅ Stock quotes and news

✅ Basic screening tools

Limitations

❌ No AI stock analysis

❌ Advertising on free tier

❌ Less focus on value investing

❌ Limited depth in fundamental analysis

Pricing

Yahoo Finance’s free tier contains much of what you would expect from a financial news website (latest updates on stocks, ETFs, mutual funds, crypto, and the economy). But it lacks much of what you need for deep stock research & confident investing. Paid tiers – available from between $9.95–$49.95 per month – fill this gap, providing technical analysis, analyst estimates, fair value analysis, and comprehensive historical data.

Alternative 6: TIKR — Best Terminal Interface

TIKR is a top platform for those seeking a Bloomberg-style alternative with a terminal interface. While it lacks the AI stock analysis features of other platforms such as Alpha Spread and Gainify, it does provide you with comprehensive global stock coverage, screeners, top investor tracking, real-time stock news powered by Reuters, company transcript data, and more.

Advantages

✅ Monitor portfolios and trading activities of 10,000+ funds and institutional investors

✅ Data on over 100,000 stocks across 92 countries and 136 exchanges

✅ Access up to 20 years of historical financial data

✅ Data powered by S&P Global CapitalIQ

✅ Reuters news integration

Limitations

❌ Text-heavy interface

❌ No AI stock analysis capabilities

❌ Steeper learning curve due to complex data and few charts or graphs

Pricing

TIKR offers three subscription tiers (each providing you with different levels of data access).

The Free timer offers basic access limited to US stocks with 5 years of financial history, 2 years of analyst estimates, and limited transcript access.

Paid tiers range from $14.95/month (unlocks global stock coverage, 10 years of financial history, and 3 years of analyst estimates) to $29.95/month (20 years of financial history, 5 years of analyst estimates, and complete transcript archives).

Final Thoughts: Which Alpha Spread Alternative Is Right for You?

After examining these top Alpha Spread alternatives, you should have a clear understanding of the advantages and limitations that each offers. While Gainify stands out as the best value for money option with the most powerful range of stock research tools (AI assistant, pre-built & custom stock screeners, top investor tracking, proprietary metrics) – you may have found that another stock research tool better meets your specific investment style, research priorities, and budget. Perhaps you require the broker integration offered by Simply Wall St., the more comprehensive stock news built in to TIKR, or the multiple asset classes covered by Yahoo Finance and Koyfin. Each alternative brings unique strengths to your stock analysis and investing approach.

When choosing between Alpha Spread and these alternatives, ask yourself:

- How important is data transparency? If having access to the best Wall Street data is important to you, consider Gainify or TIKR with their S&P Global data.

- What’s your learning style? If you’re a visual learner, you may wish to try Simply Wall St or Gainify. But if you’re seeking text-heavy interfaces you might prefer TIKR or GuruFocus.

- How many stocks do you research weekly? Alpha Spread’s limitation of 3-15 stocks weekly may be insufficient if you’re an active investor. Gainify or TIKR are better choices for comprehensive research.

- Do you need multi-asset research? If you invest beyond stocks, Koyfin and Yahoo Finance offer broader asset class coverage than Alpha Spread and other alternatives.

- How important is AI assistance? If you value AI-powered research, Gainify’s AI connected to Wall Street data enables you to speed up your stock research, analyze entire industries, compare top competitors, and more.

- What’s your budget? Gainify’s free tier offers the best entry point with the broadest range of powerful stock research features available. Paid tiers (available at $7.99–$26.99/month) offer the best value for money.

If you’re still unsure, you should test multiple platforms’ free tiers before committing to a paid subscription. By attempting to find stocks worth investing in on each platform, you will soon understand which interface and feature set best complements your investment approach.

FAQ

What is the best Alpha Spread alternative for beginners?

For beginners, Simply Wall St and Gainify offer the most user-friendly and intuitive experiences. Simply Wall St’s Snowflake visualization transforms complex financial data into intuitive graphics. Gainify’s clean interface and AI assistant allow beginners to ask questions in plain language and receive easy-to-understand insights.

Which platform has the most powerful AI capabilities?

Gainify offers breakthrough AI capabilities for stock research. Its AI assistant connects to real-time Wall Street data from S&P Global Intelligence, allowing you to ask specific investment questions, conduct competitor comparisons, deep dive into industry analysis, and get detailed earnings call summaries.

Is there a free alternative to Alpha Spread worth using?

Several platforms offer valuable free tiers that rival or exceed Alpha Spread’s free plan (which limits users to just 3 stocks per week). Gainify’s free tier provides access to all core features including AI analysis, top investor tracking, and comprehensive global stock insights. Yahoo Finance offers large amounts of market data, news, and basic portfolio tracking completely free. TIKR’s free tier provides US stock coverage with 5 years of financial history.

Which platform is best for pure value investing?

Gainify gives you access to the largest database of analyst estimates for retail investors. It also gives you proprietary metrics focused on intrinsic value. You’ll also be able to track top value investors like Warren Buffett. Guru Focus is another strong option for value investors – but it is very expensive compared to other tools and you may not be able to justify the significantly higher investment for the similar feature set offered by other platforms.

Which platform provides the most reliable data sources?

Gainify and TIKR are the most transparent about their data sources, both explicitly stating they use S&P Global Intelligence data, which is considered the gold standard for stock data.