Looking for a smarter way to research stocks? Whether you want deep financial insights from industry giants like FactSet or cutting-edge AI-powered analysis from Gainify.io, this guide breaks down the best alternatives to Simply Wall St.

Simply Wall St is great for visual stock analysis, but investing is about more than just pretty charts. If you’re looking for real-time Wall Street data, expert-backed forecasts, and pro-level valuation tools, there are smarter alternatives that can give you a real edge in the market.

In this article, we break down 10 top alternatives, each tailored to different investors, from beginners looking for guidance to seasoned professionals seeking institutional-grade research.

1. Gainify.io – Best Overall for an In-depth and AI-Powered Stock Research

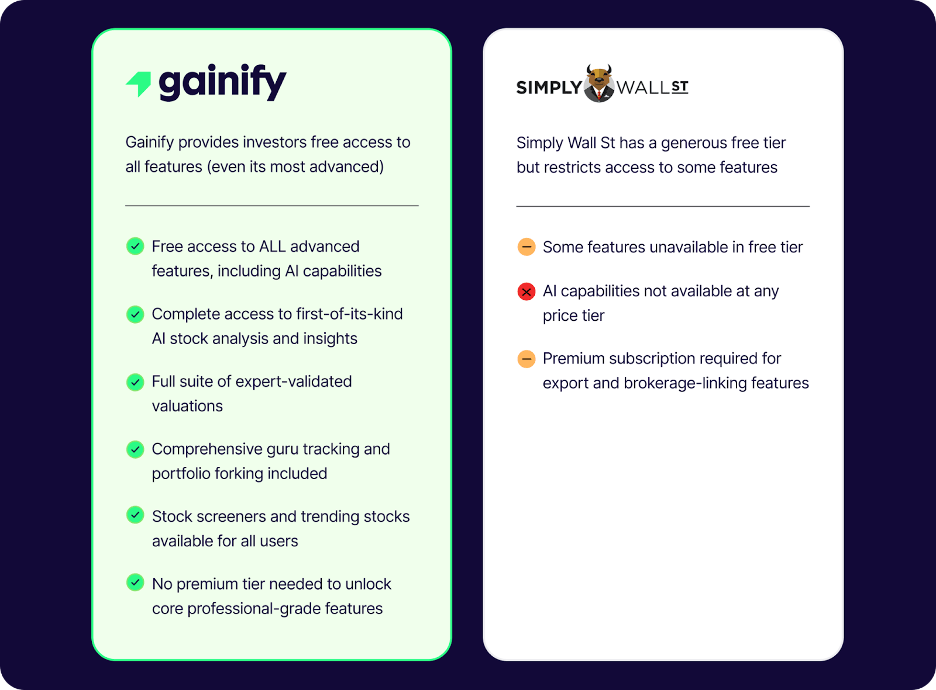

For investors seeking real-time Wall Street data and cutting-edge AI-powered insights, Gainify.io is the best alternative to Simply Wall St. It offers proprietary valuation methods, AI-driven stock analysis, and the world’s most comprehensive analyst estimate database for retail investors.

Key Features:

- AI-Powered Market Intelligence – First-of-its-kind AI connected to real-time Wall Street data, delivering instant insights that matter.

- Institutional-Grade Stock Screener – Filter 33,000+ stocks across 1,000+ metrics with real-time Wall Street data. Advanced screening capabilities with professional-grade filters deliver the insights institutional investors rely on.

- Expert-Backed Stock Valuations – Gainify’s proprietary scoring system combines analyst estimates and deep financial analysis for smarter investment decisions.

- Pre-Built Strategy Screeners – Ready-to-use stock screeners and trending stock groups help you spot opportunities fast—no setup required.

- Advanced Trend Analysis – Track the evolution of analyst forecasts vs. actual performance to uncover market shifts before they happen.

- Comprehensive Guru & Insider Tracking – Follow, analyze, and replicate top investor strategies with real-time alerts and portfolio forking capabilities.

Top 3 breakthrough tools that set Gainify apart:

Gainify AI

Gainify leads with first-of-its-kind AI connected to real-time market data, offering natural language queries, AI-powered stock analysis, and predictive insights. Simply Wall St takes a traditional approach, focusing on visual data presentation and static analysis tools – unlike Gainify, it does not offer AI stock research tools.

With Gainify AI, users can:

- Conduct deep stock analysis in a flash: Uncover detailed insights about individual stocks, revealing unique financial metrics and actionable market intelligence. Use prompts like “How is TSLA valued at the moment?

- Quickly compare companies and industries head-to-head: Get comprehensive competitor breakdowns derived from real-time S&P Global data, including detailed analytics and market premiums. Use prompts like “How do Coca-Cola and PepsiCo compare?” or “Compare Tesla’s valuation to other EV manufacturers, providing industry-wide context and unique market metrics

- Decode earnings calls instantly: Get AI-powered summaries of complex financial reports. Use prompts like “Summarize the key strategic insights from Apple’s latest earnings call” and “What were the most important financial signals in Microsoft’s quarterly report?”

Investors will also find AI insights and earnings call summaries within the Stock Summary and Stock Valuation pages.

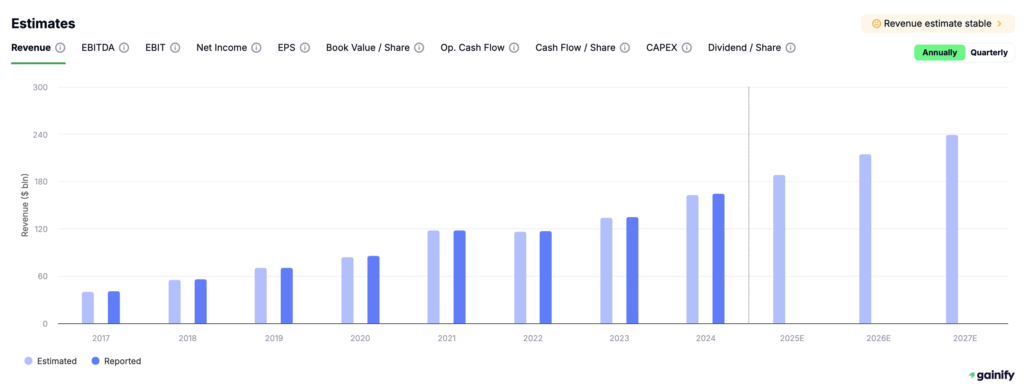

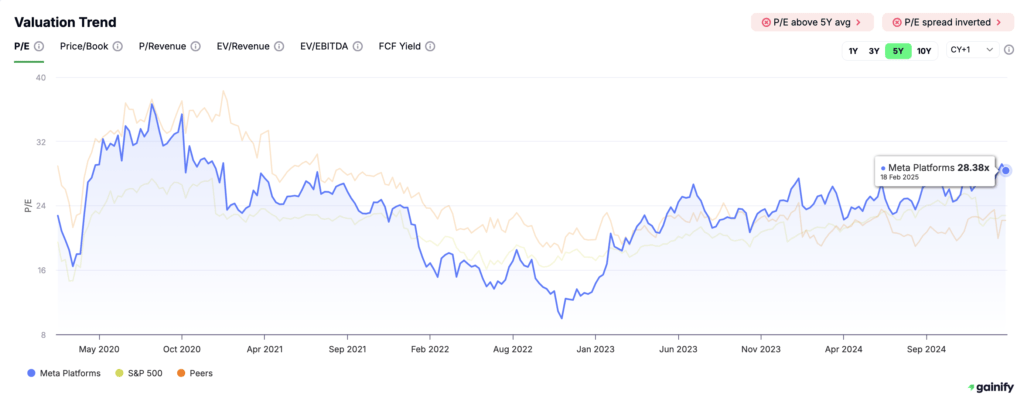

Forward-Looking Stock Intelligence

Gainify sets itself apart with access to one of the world’s largest analyst estimate databases, offering unmatched insight into Wall Street’s expectations for future company performance. While other platforms rely heavily on historic financial data, Gainify provides real-time forward-looking estimates, allowing investors to track how analysts revise their revenue, earnings, and cash flow projections over time. This institutional-grade dataset, covering thousands of global stocks, helps investors anticipate market movements and make decisions based on where companies are expected to go, not just where they have been.

Gainify also leads the industry with one of the most extensive forward multiple valuation datasets, giving investors a clearer picture of how the market is pricing stocks relative to key financial metrics. Unlike platforms that focus on past valuation ratios, Gainify continuously updates real-time forward multiples, such as price-to-earnings, price-to-sales, and free cash flow yield, to reflect how investor sentiment and expectations evolve. This enables users to identify undervalued or overvalued stocks faster, ensuring they stay ahead of market pricing adjustments.

Examples of Forward Multiples Available on Gainify:

- Forward Price-to-Earnings (P/E) – Assess how a company’s projected earnings impact its valuation compared to peers.

- Forward Price-to-Sales (P/Sales) – Understand how the market values a company’s future revenue potential.

- Forward Free Cash Flow Yield (FCF Yield) – Measure a company’s ability to generate cash flow relative to its market cap.

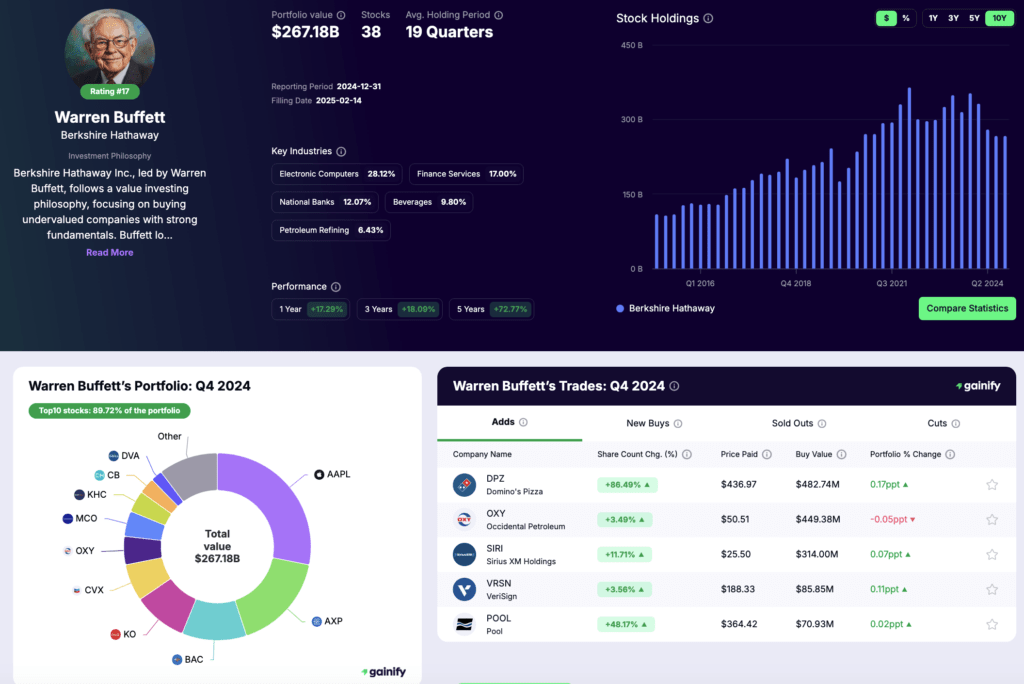

Top investor and Congress Tracking

Gainify excels in tracking the moves of elite investors and Congress members, giving users access to real-time alerts, full portfolio breakdowns, and strategy replication tools. Whether you’re following hedge fund titans, billion-dollar fund managers, or policymakers with insider insights, Gainify provides unmatched visibility into their investment decisions.

Gainify doesn’t just show you who bought what – it transforms raw data into actionable insights, helping investors mirror expert strategies, anticipate market trends, and refine their own portfolios with confidence.

Summary:

Advantages:

✅ Free access to pro-level features

✅ AI-powered real-time market insights

✅ Proprietary scoring system

✅ Institutional-grade forecasts & expert-validated valuations

✅ Advanced screeners with forward-looking valuation filters

Limitations:

❌ No broker syncing for direct trading

❌ More research-focused than trade execution-focused

❌ May be overwhelming for absolute beginners

❌ Requires some familiarity with AI tools

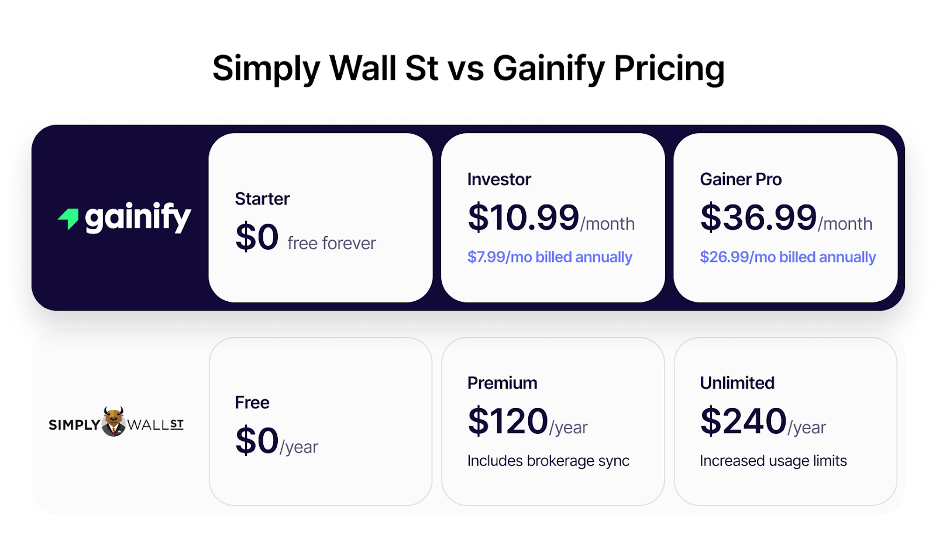

Pricing:

- Starter (FREE) – Access all core features with 10 AI queries/month, 1 year of estimates, and 1 year of historical estimates – no credit card needed.

- Investor ($10.99/mo or $7.99/mo annually) – Includes Gainify Rating, 50 AI queries/month, 3 years of estimates, and 10 years of historical estimates, plus priority support.

- Gainer Pro ($36.99/mo or $26.99/mo annually) – Includes Gainify Rating, 500 AI queries/month, 3 years of estimates, 15 years of historical estimates, and VIP support.

Gainify.io merges real-time Wall Street data with AI-driven insights, delivering pro-level stock research at the best price in the industry. Unlike Simply Wall St’s static visuals, Gainify offers forward-looking estimates, advanced valuation metrics, and instant earnings call summaries. It also tracks elite investors and Congress trades, turning raw data into actionable intelligence. For anyone seeking institutional-grade research without breaking the bank, Gainify stands out as the best overall alternative.

2. Finviz

Finviz is a well-known platform for technical traders and data-heavy investors who prefer visual stock screening, pattern recognition, and chart-based analysis. While its powerful screening tools and heatmaps provide detailed market overviews, it primarily caters to investors who rely on historical price action, technical indicators, and raw data visualizations rather than forward-looking insights or AI-driven analysis.

Key Features:

- Advanced stock screener with technical and fundamental filters.

- Market heatmaps for quick trend visualization.

- Customizable charting with technical indicators.

- Basic Insider trading and institutional ownership data.

- Backtesting tools for technical trading strategies.

Advantages:

✅ Comprehensive screening and filtering options

✅ Extensive technical analysis toolkit

✅ Customizable charts and data views

✅ All critical news in one centralized place

Limitations:

❌ Lacks forward-looking insights and AI-driven analysis

❌ Limited fundamental metrics beyond basic ratios

❌ Interface can be overwhelming for beginners

❌ Free version has delayed data and ads

Pricing:

- Free Plan – Basic screeners with delayed data, ad-supported.

- Finviz Elite ($39.50/mo or $24.96/mo annually) – Real-time data, advanced charting, and ad-free experienceFree, $24.96/month (Elite).

Finviz is a strong choice for traders focused on technical patterns and price-based screening. However, it lacks predictive analytics, AI-powered research, and institutional-grade valuation tools.

3. TradingView – Best for Day Traders

TradingView is a leading platform for day traders who rely on advanced charting, custom indicators, and community-driven insights. With over 90 million users, it has built a reputation as the go-to tool for price action traders, day traders, and algorithmic investors who prioritize historical trends and pattern recognition over forward-looking fundamental analysis.

Key Features:

- Advanced price charting with 100+ indicators & drawing tools.

- Custom scripting & trading automation with Pine Script.

- Multi-asset coverage including stocks, crypto, and forex.

- Social trading network with user-generated insights.

- Real-time & delayed data options based on subscription.

Advantages:

✅ Best for active traders & technical analysis

✅ Highly customizable charts & indicators

✅ Vibrant trading community for idea sharing

✅ Available on desktop, mobile, and web

Limitations:

❌ Limited fundamental data & valuation insights

❌ No AI-driven stock research or forward-looking analysis

❌ Some real-time data requires an extra fee

❌ Best suited for traders, not long-term investors

Pricing

- Free Plan – Basic features with delayed data and ads.

- Essential ($12.95/mo) – More indicators, no ads, and 20 technical alerts.

- Plus ($24.95/mo) – Chart data export, custom timeframes, and extra alerts.

- Premium ($49.95/mo) – premium charting, watchlist alerts, and exclusive indicators.

While TradingView is a powerhouse for technical analysis, it lacks AI-powered insights, forward-looking analyst estimates, and institutional-grade valuation tools. For investors who prioritize fundamental analysis, stock valuations, and real-time Wall Street insights, Gainify.io offers a smarter, data-driven alternative.

4. Yahoo Finance – Best for General Market Tracking & News

Yahoo Finance is a widely used platform offering broad market coverage, personalized news alerts, and basic research tools. While it serves as a reliable news and portfolio tracking hub, its insights remain primarily historical, making it best suited for casual investors who need a general market overview rather than advanced analysis.

Key Features:

- Real-time stock quotes & basic fundamental data.

- Portfolio tracking with multi-broker integration.

- News aggregation from major financial media

- Basic stock screeners for fundamental analysis.

- Historical financial data.

- Cryptocurrency & forex market tracking.

Advantages:

✅ Broad market coverage with live stock quotes

✅ Comprehensive financial news aggregation

✅ Multi-broker portfolio tracking across multiple accounts

✅ Free version available with essential features

Limitations:

❌ Lacks forward-looking insights & analyst forecast tracking

❌ No AI-powered research or automated stock analysis

❌ Basic screening tools with limited customization

❌ Free version cluttered with ads

❌ Key features locked behind premium plans

Pricing

- Free Plan – Basic quotes, news, and limited screeners.

- Bronze ($7.95/mo) – Portfolio performance analysis, community sentiment insights and subscriber-only daily newsletter.

- Silver ($19.95/mo) – Deeper research tools for stocks, including fair value analysis, insider trades and hiring scores.

- Gold ($39.95/mo) – Best for active trading, featuring expanded historical data, advanced charting, and priority support

Yahoo Finance is a strong choice for those who want easy access to market data, financial news, and basic stock research tools. While it lacks advanced predictive analysis, it remains a go-to platform for everyday investors looking to stay informed and track their portfolios in one place.

5. Fiscal.ai – Best for Comprehensive Fundamental Analysis

Fiscal.ai (formerly FinChat) is an all-in-one investment research platform that combines institutional-grade financial data with advanced AI capabilities, offering investors deep insights global public companies. With up to 20 years of financial data and company-specific KPIs, Fiscal.ai empowers users to conduct thorough analyses and make informed investment decisions.

Key Features:

- Access up to 12+ years of historical financial information, including detailed revenue and profit segments.

- Analyze granular key performance indicators for over 2,000 stocks, providing deeper insights into company operations.

- Utilize an AI assistant to answer financial queries, generate summaries, and create visualizations.

- Explore over 10,000 metrics with customizable charting options to visualize data effectively.

- Tailor your research environment with dashboards that auto-save your settings for a personalized experience.

Advantages:

✅ Extensive financial history with up to 20 years of data

✅ Granular KPI insights to track company-specific performance

✅ Excel integration for seamless financial data imports

✅ Customizable dashboards to personalize and save research views

✅ Advanced stock screener with over 300 filtering metrics

Limitations:

❌ No mobile app currently available for users

❌ Limited real-time market data for active traders

❌ Higher pricing compared to some basic research tools

❌ Requires a learning curve for new investors

❌ Lacks broker integration for direct trading execution

Pricing

- Free Plan: Includes 5 years of financial data, 2 years of Segments & KPIs, and 1 dashboard.

- Plus ($24/month billed annually or $29/month billed monthly): Offers 10 years of financial data, 5 years of Segments & KPIs, unlimited dashboards, and additional features.

- Pro ($64/month billed annually or $79/month billed monthly): Provides 12+ years of financial data, unlimited Segments & KPIs, unlimited AI prompts, Excel Add-In, and premium support.

Fiscal.ai stands out as a powerful tool for investors who prioritize comprehensive fundamental analysis, offering a blend of extensive data coverage and AI-driven insights to facilitate informed investment decisions.

6. FactSet

FactSet is a premium financial data and analytics platform designed for institutional investors, asset managers, and financial professionals. It provides comprehensive market intelligence, advanced analytics, and powerful research tools, making it a go-to solution for firms that require deep financial data, portfolio management tools, and quantitative analysis.

Key Features:

- Extensive financial and market data covering equities, fixed income, commodities, and alternative assets.

- Advanced portfolio analysis and risk management tools for institutional investors.

- Excel and API integration for seamless data extraction and modeling.

- Powerful screening and backtesting tools for quantitative research.

- AI-driven insights and predictive analytics for investment strategies.

- Global news, earnings transcripts, and real-time financial reports.

Advantages:

✅ Institutional-grade financial data with deep analytics

✅ Comprehensive portfolio management and risk analysis

✅ Robust Excel, API, and modeling integrations

✅ Highly customizable platform for professional investors

✅ Strong customer support and dedicated account managers

Cons

❌ Expensive subscription cost, primarily for institutions

❌ Steep learning curve for new users

❌ Limited retail investor accessibility

❌ Complex interface requiring advanced financial knowledge

❌ Mobile functionality is limited compared to desktop version

Pricing

- Custom pricing – Typically starts at $12,000+ per year, with additional costs for premium features and data sets.

FactSet is a powerful solution for professionals who need institutional-grade data, deep financial insights, and customizable research tools. While it comes at a premium cost, its comprehensive analytics and integration capabilities make it a top choice for serious financial professionals.

7. S&P Capital IQ Pro – Best for Institutional-Grade Investment Research

S&P Capital IQ Pro is a premium financial data and analytics platform designed for institutions, financial analysts, and corporations that require customizable data feeds, deep industry insights, and macroeconomic analysis. It offers extensive financial data, AI-powered tools, and ESG reporting, making it a top choice for firms needing robust research capabilities.

With its highly customizable API and integration capabilities, users can extract real-time and historical data for in-depth financial modeling, risk assessment, and strategic decision-making. While powerful, the platform is primarily suited for professionals due to its complexity and cost.

Key Features

- Extensive financial & industry data covering global equities, fixed income, private markets, and more.

- Customizable APIs & Excel integration for seamless data extraction and analysis.

- AI-powered document viewer for analyzing filings, transcripts, and financial reports.

- Macroeconomic & credit ratings insights from S&P Global Ratings.

- ESG & sustainability analytics for risk assessment and investment strategies.

- Supply chain intelligence to analyze company dependencies and risks.

Pros

✅ Best for institutions needing customizable financial data APIs

✅ Vast dataset with deep financial, industry, and macroeconomic insights

✅ AI-powered tools streamline research and data extraction

✅ Strong ESG & sustainability analysis capabilities

Cons

❌ Expensive, with pricing tailored for large institutions

❌ Not beginner-friendly due to its complexity

❌ Limited accessibility for individual investors and small firms

❌ No direct trading features or brokerage integration

Pricing

- Custom pricing – Costs vary based on data access, features, and organizational needs, but typically starts at $12,000+ per year. Prospective users must contact S&P Global for a quote.

S&P Capital IQ Pro is a powerful data solution for institutions and financial professionals who need high-quality, customizable datasets. While its cost and complexity make it less suitable for retail investors, it remains one of the most comprehensive financial research platforms available.

8. Koyfin

Koyfin is a powerful financial research platform designed for investors who need an advanced yet affordable alternative to Bloomberg. With a focus on deep fundamental analysis, macroeconomic insights, and a highly customizable terminal-style interface, Koyfin provides users with robust tools for tracking global markets.

The platform offers a rich set of features, including custom dashboards, advanced charting, and real-time data coverage across stocks, ETFs, bonds, and commodities. While it caters to serious investors, its steep learning curve may require some time to master.

Key Features

- Customizable dashboards and watchlists for personalized market tracking.

- Advanced graphing and fundamental analysis tools.

- Global coverage of stocks, ETFs, bonds, and commodities.

- Macroeconomic data and sector analysis tools.

- Hotkey support for seamless navigation.

- Institutional-grade financial data at a fraction of Bloomberg’s cost.

Advantages:

✅ Customizable terminal-like interface for in-depth market tracking

✅ Deep fundamental and macroeconomic insights

✅ Comprehensive financial statements with deep fundamental analysis and historical data

✅ Competitive pricing compared to Bloomberg and other premium terminals

Limitations:

❌ Steep learning curve for new users

❌ Free plan has limited features and data access

❌ Clunky user interface that may feel unintuitive for new users

❌ Lacks AI-powered research tools

❌ Higher pricing compared to some retail-focused platforms

Pricing

- Free Plan – Limited access to financial data and dashboards

- Plus ($39/month) – Includes enhanced data, charting, and watchlist customization

- Pro ($79/month) – Offers full access to global market data, advanced analytics, and premium features

Koyfin is a solid option for serious investors looking for an affordable and highly customizable financial research platform. While it lacks some of Bloomberg’s institutional features, it delivers a strong alternative for individuals and professionals who need comprehensive market analysis tools at a premium price.

9. TIKR

IKR is a financial research platform designed for investors seeking extensive global stock data. Covering over 100,000 stocks across 92 countries and 136 exchanges, it offers a mix of fundamental financial metrics, Wall Street analyst estimates, and institutional portfolio holdings.

Key Features

- Financial data for 100,000+ global stocks across multiple exchanges.

- Wall Street analyst estimates for earnings, revenue, and valuation projections.

- Institutional portfolio tracking showing holdings from hedge funds and major investment firms.

- Stock screener with customizable filters for fundamental and technical research.

- Watchlists and portfolio tracking tools for investment monitoring.

Advantages:

✅ Covers a broad range of global stocks

✅ Extensive hedge fund and portfolio tracking tools

✅ Institutional-grade data sourced from S&P Global

✅ Regular updates to improve features and data coverage

Limitations:

❌ Limited KPI and segment data compared to competitors

❌ User interface could be improved for better navigation and usability

❌ No AI-powered insights or predictive analytics for forward-looking research

❌ Free plan has delayed data and restricted analyst estimates

Pricing

- Free Plan – Access to stock data, analyst estimates, and basic watchlists

- Plus ($19.95/month) – 10 years of financial data, more screeners, and increased analyst estimates

- Pro ($39.95/month) – Unlimited stock screening, full global financial data, and portfolio tracking

TIKR is an excellent choice for retail investors and long-term traders seeking global stock coverage, analyst estimates, and institutional tracking at a competitive price. However, its lack of KPI data, limited real-time capabilities, and UI challenges mean that investors requiring more advanced tools may need to look elsewhere.

10. AlphaSpread – Best for Intrinsic Valuation

AlphaSpread is a stock valuation platform designed to help investors determine the intrinsic value of stocks using most popular valuation methods. It offers automatic intrinsic valuation, Wall Street estimates, and comprehensive fundamental analysis, making it a valuable tool for those seeking to make informed investment decisions.

Key Features:

- Automatic intrinsic valuation to estimate stock worth.

- Discounted cash flow (DCF) calculator for fair value estimates.

- Valuation backtesting to test past investment strategies.

- Fundamental analysis with financial statement insights.

- AI-powered investment analyst for quick valuation insights.

Advantages:

✅ Price alerts and watchlist tracking

✅ Educational resources on valuation techniques

✅ Backtesting to review past valuation accuracy

✅ Supports multiple valuation models beyond DCF

Limitations:

❌ Limited KPI and financial segment data

❌ Free plan offers restricted access to stock valuations

❌ Lacks in-depth sector and industry analysis

❌ Watchlist limitations on free and mid-tier plans

Pricing:

- Free Plan ($0/month) – Limited access with 3 stock valuations per week.

- Premium Plan ($12/month) – Up to 15 stock valuations per week with expanded features.

- Unlimited Plan ($20/month) – Full access to all stocks and valuation tools with no restrictions.

AlphaSpread stands out as a reliable platform for investors aiming to assess the true value of stocks through automatic intrinsic valuation and fundamental analysis. Its combination of user-friendly tools and advanced features makes it a noteworthy option for those committed to value investing.

Final Thoughts: Which Alternative is Best for You?

Choosing the right stock research platform depends on your investing style, data needs, and level of expertise. Here’s a quick summary of the best alternatives to Simply Wall St based on different use cases:

- Best Overall Alternative: Gainify.io

- Best for Fundamental Analysis: Fiscal.ai

- Best Bloomberg Alternative: Koyfin

- Best for Institutional Investors: S&P Capital IQ Pro

- Best for Intrinsic Valuation Tools: AlphaSpread

- Best for General Market Tracking: Yahoo Finance

- Best for Day Traders: TradingView

While Simply Wall St is a great entry-level tool for beginners, these alternatives provide more advanced data, AI-powered insights, and institutional-grade research capabilities. Whether you’re looking for technical charting, deep fundamental analysis, or AI-driven investment research, there’s a platform that can help you make more informed investment decisions.