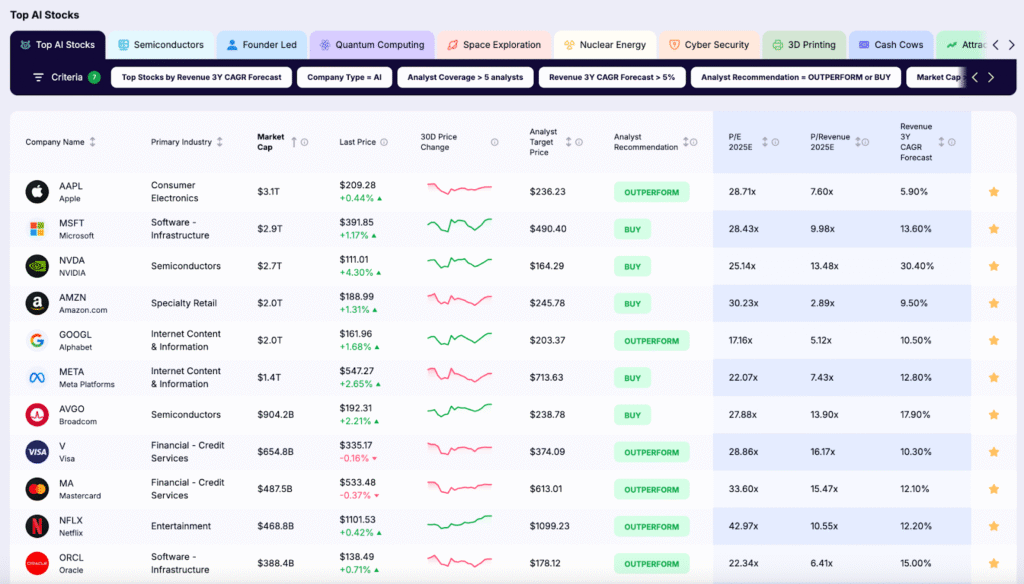

Artificial Intelligence (AI) is no longer just a tech buzzword. It has become the engine of innovation across industries like finance, healthcare, automotive, and cloud computing. For investors looking to position themselves for the future, understanding the biggest AI companies by market cap and the key private players emerging alongside them is critical.

In this guide, we break down the major public companies leading the AI revolution, including Microsoft, Alphabet (Google’s parent company), Amazon, Nvidia, and more. We also highlight important honorable mentions like Taiwan Semiconductor, ASML, AMD and Palantir, and spotlight private generative AI companies such as OpenAI, Anthropic, and Perplexity AI.

Together, these companies are shaping the next phase of global growth by building the platforms, cloud services, and generative AI models that will power the economy for decades. Whether you are looking for large-cap AI leaders or early movers in specialized areas like language models, machine learning, and AI-driven insights, this overview provides a comprehensive look at the businesses redefining the landscape of artificial intelligence.

1. Microsoft (MSFT)

Market Cap (as of 04/25/2025): $2.9T

AI Angle: Microsoft has made Artificial Intelligence a central part of its business. Through its major partnership with OpenAI, the creator of ChatGPT, Microsoft has brought AI directly into the tools people use every day. Services like Azure AI, Office Copilot, and GitHub Copilot for developers are helping businesses and individuals work smarter and faster.

Azure AI plays a critical role by giving companies the cloud infrastructure and powerful machine learning tools they need to build, train, and deploy their own AI models. It allows businesses across industries to unlock actionable insights, automate processes, and deliver better customer experiences. Many of Microsoft’s leading AI innovations have been developed in hubs like San Francisco.

Investor Insights: Microsoft is not just benefiting from the rise of AI. It is helping to build the foundation for it. Its strong partnerships, especially with OpenAI, and the rapid growth of Azure cloud services give it a major competitive advantage. As demand for generative AI and machine learning continues to accelerate, Microsoft is well-positioned to stay a global leader and drive long-term growth for investors.

2. Nvidia (NVDA)

Market Cap (as of 04/25/2025): $2.7T

AI Angle: Nvidia has become the essential hardware provider behind the AI revolution. Its high-performance GPUs (graphics processing units) power everything from generative AI models like ChatGPT to self-driving cars, healthcare AI applications, and advanced robotics.

Nvidia’s AI chips, including the H100 and A100 series, are critical for training large language models and running complex machine learning workloads at scale. In addition to powering cloud services and AI research, Nvidia is also helping industries like automotive, finance, and healthcare deploy AI solutions faster and more efficiently.

Investor Insights: Nvidia’s dominance in AI hardware places it right at the center of the artificial intelligence economy. As demand for AI accelerators, generative AI infrastructure, and machine learning hardware continues to surge, Nvidia’s annual revenue from its data center and AI segments is growing rapidly. With first-mover advantage, deep technology leadership, and strong partnerships across cloud providers and enterprises, Nvidia remains a cornerstone holding for investors focused on the future of AI.

3. Alphabet (GOOGL & GOOG)

Market Cap (as of 04/25/2025): $2.0T

AI Angle: Alphabet, the parent company of Google, has been a leader in Artificial Intelligence for over a decade. Its DeepMind division, famous for breakthroughs like AlphaGo and AlphaFold, continues to push the limits of machine learning research.

Today, Alphabet’s AI strategy is deeply integrated across its businesses. Google Cloud offers generative AI models that help companies build smarter applications, automate tasks, and deliver faster, AI-driven insights. Gemini, Google’s next-generation large language model, is designed to compete with systems like OpenAI’s GPT, powering everything from enterprise tools to advanced consumer products. Even Google’s core search engine now uses AI to provide more accurate and personalized results. Much of Alphabet’s AI research and innovation is centered in hubs like San Francisco.

Investor Insights: Alphabet’s wide reach in AI creates multiple paths for growth. Through Google Cloud, healthcare analytics, advertising, and consumer products, it is embedding AI into services that billions of people rely on every day. With strong leadership in generative AI models, language models like Gemini, and critical partnerships across industries, Alphabet stands out as a durable and essential player in the future of artificial intelligence.

4. Amazon (AMZN)

Market Cap (as of 04/25/2025): $2.0T

AI Angle: Amazon has built some of the most widely used AI applications in the world. Its recommendation engines, Alexa voice assistant, and cloud infrastructure all run on powerful AI systems.

The biggest driver of Amazon’s AI leadership is AWS (Amazon Web Services), which offer the cloud services that help companies build, train, and deploy their own AI solutions. AWS is expanding aggressively in generative AI, offering tools like Bedrock for custom model development and Trainium chips for AI training at scale. These services allow businesses across industries to create smarter applications, automate operations, and deliver faster, AI-driven insights to customers.

Investor Insights: AWS remains Amazon’s main profit engine and its key to long-term growth. As demand for cloud computing, AI infrastructure, and enterprise generative AI models continues to surge, Amazon’s annual revenue from cloud services is expected to grow steadily. With strong partnerships, first-mover advantages in cloud AI, and an expanding suite of AI tools, Amazon is well-positioned to remain one of the top technology and artificial intelligence companies globally.

5. Meta Platforms (META)

Market Cap (as of 04/25/2025): $1.4T

AI Angle: Meta has made Artificial Intelligence a central focus of its business transformation. It is using AI to significantly improve Facebook algorithms, Instagram algorithms, and WhatsApp messaging services, leading to better content recommendations, stronger ad targeting, and higher user engagement.

A key part of Meta’s strategy is its development of the Llama family of generative AI models. These models are designed to compete directly with leading AI systems like OpenAI’s GPT, and they are being integrated across Meta’s platforms to power smarter interactions and personalized experiences. Meta is increasingly using AI-driven insights to better understand customer behavior, optimize advertising, and support the next generation of social and messaging products.

Investor Insights: Meta’s aggressive pivot toward AI has re-energized its financial performance and market outlook. By embedding generative AI models deeply into social media and advertising ecosystems, Meta is creating highly sticky platforms that drive steady annual revenue growth. With its expanding AI capabilities and vast global user base, Meta remains a powerful long-term play for investors seeking exposure to the rise of artificial intelligence.

6. Tesla (TSLA)

Market Cap (as of 04/25/2025): $918B

AI Angle: Tesla has placed Artificial Intelligence at the core of its mission to revolutionize transportation and energy. Its AI efforts are primarily focused on autonomous driving, robotics, and energy optimization.

A major centerpiece of Tesla’s AI strategy is the Dojo supercomputer, a custom-built platform designed to train its Full-Self Driving (FSD) models faster and more efficiently. The goal is to create self-driving cars that can operate safely with minimal human intervention. Tesla’s deep investment in AI training, real-world data collection, and advanced simulation gives it a significant advantage over traditional automakers.

Investor Insights: Tesla is no longer just an automotive company. It is increasingly seen as an artificial intelligence company that is disrupting multiple industries, starting with transportation. As adoption of self-driving cars becomes mainstream, Tesla’s first-mover advantage in AI and autonomous systems could drive exponential revenue growth across automotive, robotics, and energy sectors, offering major upside potential for long-term investors.

7. Broadcom (AVGO)

Market Cap (as of 04/25/2025): $904B

AI Angle: Broadcom plays a critical role in the AI ecosystem by providing the essential networking chips, cloud computing hardware, and custom AI chips that power the world’s largest data centers.

Its technology is vital for supporting the massive amounts of data traffic generated by AI workloads, including training large language models and running complex generative AI applications. Broadcom’s hardware is embedded deep within the infrastructure that enables cloud services, AI research, and enterprise AI deployments.

Investor Insights: As demand for bandwidth, cloud services, and AI-driven infrastructure accelerates, Broadcom’s strategic position becomes even more valuable. With its strong presence across critical industries and partnerships with major cloud providers, Broadcom stands out as an attractive infrastructure play within the rapidly expanding artificial intelligence economy.

Honorable Mentions

8. Taiwan Semiconductor Manufacturing Company (TSM)

Market Cap (as of 04/25/2025): $692B

AI Angle: Taiwan Semiconductor Manufacturing Company (TSMC) is the world’s leading producer of advanced semiconductors and critical AI chips that power the next generation of technology.

TSMC manufactures the specialized processors used by major generative AI companies like Nvidia, AMD, and Apple, helping them scale their AI innovations globally. Its chips are the foundation behind many large language models, machine learning applications, and cloud services.

Investor Insights: As the world’s most important chip foundry, TSMC plays an irreplaceable role in the artificial intelligence economy. Its strong position in AI, cloud services, and automotive industries ensures consistent demand from the biggest names in technology. With unmatched manufacturing expertise and deep exposure to high-growth sectors, TSMC offers investors resilience, strong revenue streams, and long-term upside tied to the AI revolution.

9. Palantir Technologies (PLTR)

Market Cap (as of 04/25/2025): $265B

AI Angle: Palantir specializes in delivering AI-driven insights through its powerful data analytics platforms. Its flagship products, Foundry and Gotham, help governments, enterprises, and professional services companies transform massive amounts of raw data into actionable intelligence.

Palantir’s platforms are increasingly powered by generative AI and machine learning tools, allowing organizations to make faster, smarter decisions across industries such as defense, healthcare, finance, and manufacturing. As the demand for AI-driven analytics grows, Palantir is expanding its reach beyond government contracts into the broader commercial sector.

Investor Insights: Palantir’s unique strength lies in its ability to integrate artificial intelligence directly into critical decision-making processes. With its expanding use of generative AI models, strong partnerships with major industries, and growing commercial client base, Palantir is positioning itself as a key player in the future of enterprise AI. For investors, Palantir offers exposure to a differentiated, fast-growing corner of the AI economy.

10. AMD (AMD)

Market Cap (as of 04/25/2025): $156B

AI Angle: AMD is rapidly expanding its presence in Artificial Intelligence by offering high-performance GPUs and AI accelerators that are critical for cloud computing and generative AI workloads.

With products like the MI300 series, AMD is providing powerful alternatives to Nvidia’s dominant chips, helping businesses train large language models, power generative AI applications, and scale AI infrastructure. AMD’s growing portfolio is gaining traction in data centers, cloud platforms, and enterprise AI deployments.

Investor Insights: As demand for alternatives to Nvidia rises, AMD is emerging as a serious competitor in the AI hardware space. Its strategic focus on generative AI models, competitive product roadmaps, and partnerships with major cloud providers position AMD for strong future growth. For investors, AMD represents a compelling opportunity to invest in the rapidly expanding AI and cloud infrastructure ecosystem.

Key Private Generative AI Companies

11. OpenAI

Valuation based on the last funding round (as of 04/25/2025): $300B

Role: OpenAI, based in San Francisco, is widely regarded as the leader of the modern generative AI movement. The company created ChatGPT, one of the most successful AI products in history, bringing natural language interaction to the mainstream. Its GPT-4 model set new standards for natural language processing (NLP), content generation, and human-like conversation.

Beyond consumer applications, OpenAI’s technologies are deeply integrated into enterprise solutions, including partnerships with Microsoft Azure and Salesforce. OpenAI’s influence on cloud services integrations, AI adoption across industries, and enterprise productivity is reshaping how businesses use AI at scale. With continued investment into multimodal models, robotics, and next-generation AI safety research, OpenAI remains the benchmark for innovation in the AI space.

12. Anthropic

Valuation based on the last funding round (as of 04/25/2025): $60B

Role: Anthropic, founded by a group of former OpenAI researchers, focuses on building safe, reliable, and aligned generative AI models. Its flagship product, Claude, is designed to deliver more understandable, ethical, and user-friendly AI interactions compared to many first-generation systems.

Anthropic emphasizes transparency, controllability, and safety in AI development, making it a favorite partner for organizations prioritizing responsible AI usage. Its technology is aimed at both enterprise applications and consumer-facing tools. As companies demand AI systems that are not just powerful but also trustworthy, Anthropic’s commitment to building aligned AI models positions it for major growth in critical industries.

13. Perplexity AI

Valuation based on the last funding round (as of 04/25/2025): $9B

Role: Perplexity AI, headquartered in San Francisco, is redefining how users search for information by combining generative AI models with advanced knowledge discovery techniques. Instead of traditional keyword-based searches, Perplexity provides dynamic, context-rich, conversational answers to user queries.

Its platform is designed to offer real-time, cited sources, giving users more transparent and verifiable information. Positioned as a next-generation search alternative, Perplexity is gaining attention for blending generative AI capabilities with trustworthy data retrieval. As businesses and consumers seek faster, smarter ways to access knowledge, Perplexity AI is emerging as a promising leader among private generative AI companies.

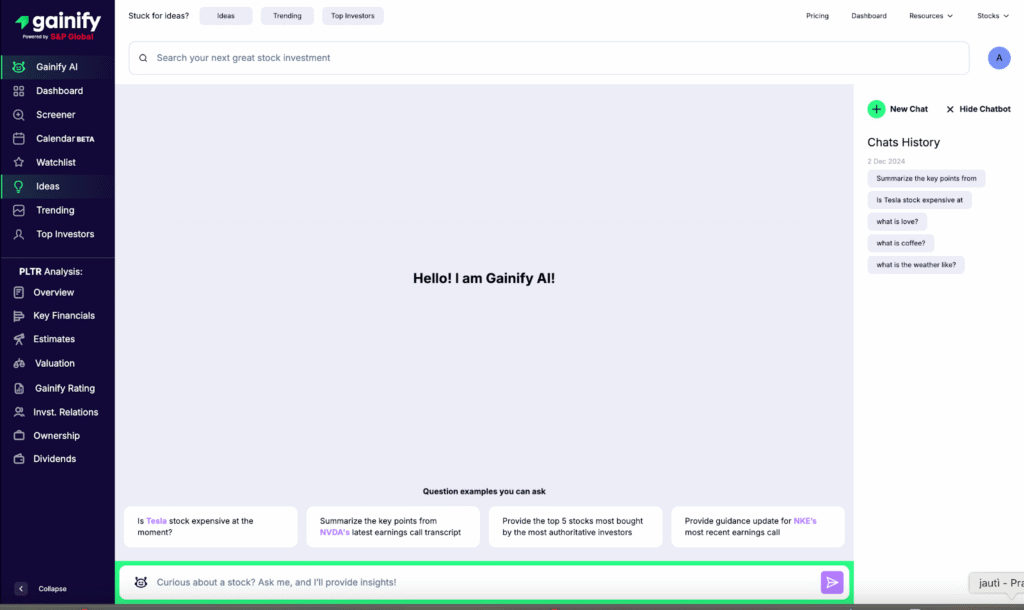

Gainify.io: The Breakthrough AI powered stock research assistant

Gainify is built by investors, for investors – with an Ex Citi Analyst and M&A specialist at the helm as Chief Product Officer. Its AI powered stock research assistant and earnings call analysis tool are trained and designed to give you maximum insight for confident investing. All AI features are connected to real time Wall Street data from gold-standard stock data provider S&P Global Intelligence.

With Gainify AI you’ll be able to:

- Analyse stocks: Get investing insights you can rely on whether you’re seeking to deep dive into an individual stock, compare competitors, or create industry reports.

- Summarize earnings calls: Save hours of manual research by summarizing earnings calls to uncover key strategic insights, performance indicators, and forward guidance. Earnings calls often hold insights critical for a stock’s future trajectory.

- Access analyst estimates: Gainify AI can give you insights from the world’s largest database of analyst estimates for retail investors. This includes historical context (how estimates have evolved in the past) and 3-year forward projections for key metrics like EPS, revenue, and EBITDA.

- Access Gainify’s proprietary metrics: Unique composite indicators focus on uncovering a stock’s future value. Gain unprecedented insights into a stock’s Performance, Momentum, Valuation, Outlook, and Health.

Final Thoughts

Artificial Intelligence is reshaping industries and economies. Whether you’re looking for infrastructure plays (like Nvidia or TSMC), software giants (like Microsoft or Alphabet), or AI-enhanced customer experiences (like Tesla and Meta), opportunities abound. The best generative AI companies are combining technology, scale, and strong partnerships to dominate their niches.

Anduril Industries, though not listed here, is another emerging player leveraging AI across defense and security sectors.

Tools like Gainify, an AI-driven research platform, can help investors dig deeper into company valuations, rankings, and AI adoption rates. Staying informed with actionable insights is critical as the landscape evolves.

As always, diversify carefully and think long-term. AI is a marathon, not a sprint.

Disclaimer: This article is for informational purposes only and is not financial advice. Always do your own research or consult with a professional before making investment decisions.