FactSet, an enterprise-tier securities research platform that stands out for its extensive data integrations (you can connect to 100+ third-party and 40+ proprietary datasets).

If big data is a part of your workflow, FactSet empowers you to ingest shipping & supply chain data, market data, security data, M&A information, and more. All this can be connected to your internal content assets to provide informed answers to complex questions. FactSet’s entity master enables you to link external data to your models without needing to code. It’s little surprise that FactSet was awarded the ‘best data marketplace award‘ at the A-Team Data Management Insight USA Awards 2024.

AI tools connect to your data to answer your critical questions and automate stock research tasks. You’ll speed up your decision making and have confidence knowing insights are backed by big data.

If you’re an institutional investor, you will appreciate FactSet for its banker efficiency and investor relations features.

However, while FactSet may seem like the dream securities research platform, FactSet may not be for everyone. One of the main reasons investors seek an alternative is the price, with Vendr listing an average investment of $45,000 per year. Retail investors (those investing with their own money, rather than on behalf of clients) are unlikely to require investor relation, custom data ingestion, and banker efficiency tools.

In this blog, you will learn about retail investor-friendly platforms such as Gainify and Fiscal.ai. We’ll show you how you can get enterprise-tier features at a fraction of the cost, with platforms dedicated to providing you with AI stock analysis, Wall Street data, top investor tracking, and more.

If you are an institutional investor, we put FactSet head to head with other enterprise-tier platforms such as AlphaSense, S&P Capital IQ, and Bloomberg. You’ll also discover retail investor platforms with breakthrough AI features to power your stock research process.

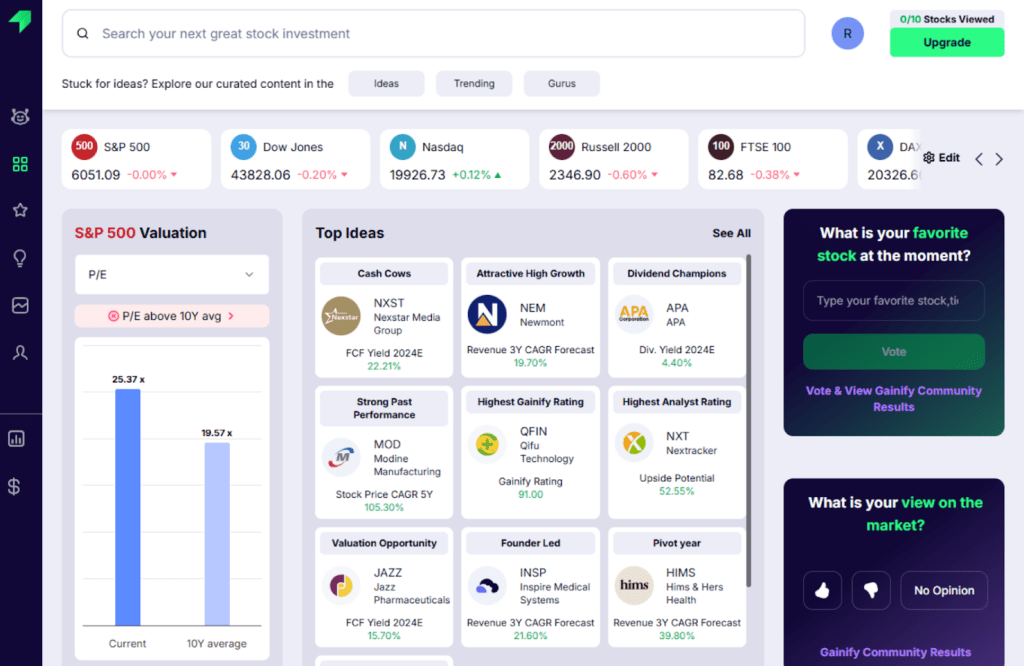

1. Gainify.io – Best for AI Stock Analysis, Access to Analyst Estimate Database, Top Investor Tracking

Gainify is for you if you want to understand a stock’s true intrinsic value – rather than simply tracking price movements.

If you’re a retail investor, it’s your go-to platform for Wall Street data at affordable prices. In fact, users on the free plan get full access to all platform features, including data from S&P Global intelligence.

You will also find breakthrough AI features & analysis, top investor tracking, proprietary metrics not found on any other platform, and an unwavering commitment to helping you uncover your next winning trade.

Institutional and retail investors alike will find Gainify’s streamlined dashboard a welcome improvement upon terminal style dashboards, and its AI tools (built by investors for investors) indispensable in optimizing research workflows.

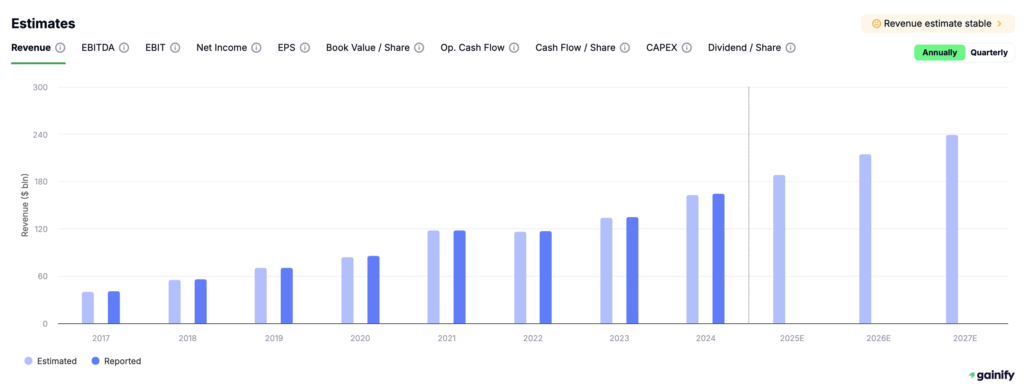

Forward-looking estimates & historical revision data

Gainify is one of the few platforms to elegantly combine historical revision data and forward looking estimates into an easy-to-interpret dashboard. All using the world’s largest analyst estimate database. With it, you can understand how accurate analyst revisions have been in the past (and if they tended to over or underestimate), and get 3-year forward projections on those same metrics.

You have access analyst estimate history and forward projections for a range of key metrics, including:

Gainify AI

Gainify’s proprietary AI connects to real-time Wall Street data from S&P Global Market Intelligence and is trained specifically for financial analysis. Ask the AI assistant your most important stock research questions for instant insights. It’s like having your own stock analyst available 24/7.

Ask investment research questions like:

- Competitor comparisons: “How does AMD compare to NVIDIA? What is the outlook for both?”

- Industry research: “Compare the top companies in the semiconductor industry”

- Company deep-dive: “What is the Gainify view for Amazon?”

- Dividend finder: “Which companies offer the best dividends?”

Gainify AI also provides earnings call summaries, showing you key highlights, key debates, and guidance/future outlook for up to 10 years of earnings call history.

Top Investor Tracking

Out of all the stock research platforms mentioned here, Gainify is the one you will likely find best for top investor tracking. It combines comprehensive and up-to-date information about top investor and congress member trades with the ability to compare top investor’s portfolios head-to-head, and fork top performing portfolios to your watchlist.

While other platforms may provide investor tracking, they often overwhelm with large amounts of text data (that is hard to read and draw insights from). Gainify’s clear user interface makes it quick and easy to identify key insights to inform your stock trading.

Advantages

Gainify really stands out amongst the competition thanks to its affordable pricing paired with breakthrough AI capabilities. A rare combination. If you’re an institutional investor you will find streamlined AI research a welcome addition to your workflow. If you’re a retail investor, you will benefit from Wall Street data and proprietary value-focused metrics at a fraction of the price you would pay for enterprise-tier platforms.

✅ Institutional-grade forecasts & expert-validated valuations

✅ Advanced screeners with forward-looking valuation filters

✅ Free access to pro-level features

✅ AI-powered real-time market insights

✅ Proprietary scoring system

Limitations

If you’re a frequent trader who appreciates 2-way sync between your brokerage account and the ability to execute trades, then pair Gainify with a stock trading tool for the best of both worlds.

❌ More research-focused than trade execution-focused

❌ May be overwhelming for absolute beginners

❌ Requires some familiarity with AI tools

❌ No broker syncing for direct trading

Pricing

All Gainify users (even those on the free tier) can access the full suite of features – including AI chatbot queries and top investor tracking. The main difference between each tier is how often you can use each feature.

- The Starter (FREE, no credit card required) gives full access to all core features with 10 AI queries per month, 1 year of estimates, and 1 year of historical estimate development.

- The Investor plan ($10.99/mo or $7.99/mo annually) includes Gainify Rating, 50 AI queries/month, 3 years of estimates, and 10 years of historical estimates, plus priority support..

- The Gainer Pro plan ($36.99/mo or $26.99/mo annually) provides a massive 500 AI queries per month, Gainify rating, 3 years of estimates, 15 years of historical estimates, and VIP support.

2. Fiscal.ai (FinChat) – Best for KPI & Segment Data

Like Gainify.io – Fiscal.ai is another new platform on the block (new, compared to established enterprise players like FactSet). It also offers access to S&P Global Intelligence data, and an AI chat assistant.

With Fiscal.ai, you can build your investment strategy on:

- Price targets and ratings Analyst estimates

- Price targets and ratings

- Competitor comparisons

- Earnings transcripts

- Dividend history

- Ownership data

- Filings

What really sets Fiscal.ai apart however, is company KPI data. With it, you can discover (for example) the number of premium subscribers Shopify has, or a company’s Ad-supported versus Premium revenue.

While Gainify offers all features to all users, including free subscribers, Fiscal.ai does gate some of its tools – restricting access to analyst price targets and analyst estimate revisions to Plus or Pro users.

If you’re a potential enterprise client looking to integrate an LLM chatbot into your own app or stock analysis workflow, Fiscal.ai offers the white-label Fiscal.ai copilot and API.

Advantages

Fiscal.ai extensive historical data, unique company KPIs, and API integration make it a powerful platform for retail investors. Especially those who can code and build their own app or process on top of the Fiscal.ai API.

✅ API and white-label copilot for tech savvy investors

✅ Extensive financial history with up to 20 years of data

✅ Advanced stock screener with over 300 filtering metrics

✅ Granular KPI insights to track company-specific performance

✅ Customizable dashboards to personalize and save research views

Limitations

While Fiscal.ai does have many of the features you will need for stock research, trading stocks is currently not available. It is also not as easy to get accustomed to for new investors as a platform like Gainify, with its streamlined interface and easy-to-interpret charts.

❌ No mobile app currently available for users

❌ Requires a learning curve for new investors

❌ Limited real-time market data for active traders

❌ Lacks broker integration for direct trading execution

❌ Higher pricing compared to some basic research tools

Pricing

Fiscal.ai offers three tiers – Free, Plus ($288 billed annually or $29/month billed monthly), and Pro ($768 billed annually or $79/month billed monthly).

Access to some features is restricted. Analyst Estimates are not available unless you have upgraded to the Plus tier. Access to Analyst Estimate Revisions requires upgrading to the Pro tier.

Historical data depth is also restricted:

- Free tier: 5 years of financial data and 2 years of Segments & KPIs.

- Pro tier: 10 years of financial data and 12 years Segments & KPIs.

However the free tier is still very generous.

3. S&P Capital IQ Pro – Best for Institutional-Grade Data

If you’re an investment banker, equity researcher, asset manager, M&A specialist, or corporate finance expert, then S&P capital IQ is well suited to your institutional workflows.

With Capital IQ you can:

- Analyze reports and company security data

- Uncover supply chain intelligence

- Build financial modelling tools

- Create peer comparisons

- Access credit ratings

- Backtest strategies

Capital IQ boasts global data covering over 62,000 public companies and 54 million private firms. Additionally, you can uncover insights on more than 90,000 Private Equity and Venture Capital funds.

For those working on private debt deals, you will find a strong advantage in Capital IQ thanks to extensive AUM, dry powder, and private capital investment data.

Key data sources you will find within Capital IQ include:

- Estimates metrics: Current and historical consensus estimates, estimate revisions, and more to identify trends and understand sentiment.

- Ownership details: Equity share ownership data for public companies, including buy/sell trade tracking so you can track investor’s trading activity.

- Transactions data: Detailed funding round, M&A deal size, public offering, and related data to compare deals, assess potential deals, or build exit strategies.

- Macroeconomic data: Global economic forecasts, industry-level supply/demand forecasts, consumer spending category forecasts, and more to identify opportunities around the world.

This broad and deep data coverage has been further enhanced by Capital IQ’s AI tools. You will be able to analyze company filings, earnings calls, latest news, and more to uncover insights faster using AI. Simply ask the Capital IQ AI chatbot your market research questions and get answers you can trust, all based on Capital IQ’s premium data.

Advantages

S&P Capital IQ’s major advantage is its established reputation as the industry standard for institutional traders and analysts. Hard to come by supply chain, investor activism, and regulatory data all add to Capital IQ’s appeal for professional investors.

✅ AI generated summaries of filings and earnings calls

✅ AI chatbot for streamlined securities research

✅ Investor activism data and regulatory data

✅ Global public and private company data

✅ Private Equity and Venture Fund data

✅ Private debt data and credit ratings

✅ Supply chain intelligence

✅ Data export (Excel)

Limitations

You won’t find a lot of drawbacks or limitations in the Capital IQ offering. However, if you’re a retail investor, it may simply be unaffordable.

❌ Expensive (aimed at enterprise customers)

❌ Better suited to finance professionals, not retail investors

❌ Retail investors may not make full use of all features, even if given access

Pricing

If you want up to date S&P Capital IQ data, you will likely need to speak to their sales team for a quote.

Data from Vendr does provide some insights into how much others are paying for access, however. Based on this, prices start from approximately $16,000 per year.

4. AlphaSense – Best for Expert Interviews and Transcripts

FactSet is known for its comprehensive banker efficiency, investor relation tools, and data integrations. AlphaSense, too, has similar features targeted at the team & client collaboration needs of enterprise-tier customers.

AlphaSense is built to streamline your complex enterprise workflows, including:

- Competitive intelligence

- Due diligence

- Earnings analysis

- Fundamental research

- Market landscaping

- Private market intelligence

What makes AlphaSense truly stand out from other enterprise-tier offerings, however, is its alternative data sources. For example, if you need to go beyond simple price data to get unique strategic insights, you can access an expert transcript library where you will find interviews with:

- Former executives

- Competitors

- Customers

Within the library, you will find over 175,000 transcripts covering both public and private companies.

If you want information about a company that is not in the library, or from a specific expert, you can request a one-on-one call. Personal access to experts (pre-qualified by AlphaSense) is your “access all areas” pass to hard-to-find technical expertise, and internal stakeholder insights.

Another strong advantage you will find when using AlphaSense is found in its AI capabilities.

- Smart summaries: Quickly analyse the bull and bear cases for a security, generate SWOT analyses in seconds, create research summaries for industries or your portfolio, create competitive analyses, and more.

- Thematic searches: Find hidden news and trends relevant to you. For example, search ‘carbon neutrality series B’ and find startups who have both 1) raised a series B recently, and 2) have a commitment to carbon neutrality or offer services to help other companies achieve carbon neutrality.

It was AI features like these that helped AlphaSense win the WatersTechnology ‘Best AI/Machine Learning Data Initiative’ award in 2024.

Advantages

AlphaSense is best suited for you if you work in asset management, a hedge fund, private markets, investment or corporate banking, or sell-side research.

✅ Expert call transcripts

✅ Download charts and images

✅ Compare changes in SEC charts with blacklining

✅ Export company filings tables to spreadsheets

✅ Collaborate, take notes, and share information with your team

✅ Search with AI (including within your company’s internal content & data)

Limitations

If you’re an institutional investor with enterprise tier stock research needs and a large corporation to purchase access for you, then there are not a lot of limitations to be concerned about.

However, if you’re a retail investor, you will find two major limitations. First, AlphaSense is expensive. Too expensive for most retail investors. Second, AlphaSense’s main drawcard (alternative data sources and expert interviews) are not a great fit for your stock research needs.

❌ Retail investors are unlikely to gain much value from expert interviews

❌ Limited visualization tools means lots of dense text data

❌ Cost is a hurdle for retail investors and smaller firms

Pricing

AlphaSense is likely prohibitively expensive for you if you’re a retail investor. Accessing the platform via the AWS Marketplace will cost approximately $20,000 per year.

If AlphaSense’s pricing is out of reach, then a platform like Gainify will give you similar access to Wall Street data and AI tools for stock research at a fraction of the cost.

5. Bloomberg – Best for Team Workflows and Deal Data

Bloomberg is a full-suite offering catering to both individual investor workflows and team collaboration needs.

- For teamwork: Access team-focused features to help you increase per salesperson revenue, client per salesperson coverage, customer satisfaction, live chat with colleagues and more.

- For individuals: Utilize independent research from over 1500 sources, chat with Bloomberg’s own analysts within the terminal, and get one-click AI insights.

Bloomberg is designed to optimize workflows across compliance, portfolio tracking, risk management, order management, deal analysis (M&A and IPOs), research, and more.

Advantages

Bloomberg’s dedicated client relationship tools, mobile app, and extensive learning materials make it a go-to solution for fast-moving teams who need to operate in sync at the highest levels of stock research & trading.

✅ DASH dashboard for sales & trading team collaboration

✅ Live chat with financial community

✅ Integrates with internal data

✅ Real-time information

✅ Company screening

✅ Commodity tracking

✅ Equity analysis

✅ Deal analysis

✅ Mobile app

Limitations

While Bloomberg offers detailed learning resources, it does still have a steep learning curve and is better suited to finance professionals.

❌ Retail investors are unlikely to benefit from the full range of features

❌ Most individuals and smaller firms will find Bloomberg too expensive

❌ Interface is complex and requires dedicated training to operate effectively

Pricing

Current Bloomberg pricing as of 2026 is reported to start at $32,000 annually per user. Small volume discounts may be available for firms with multiple subscriptions.

6. TIKR – Best for Low Cost Terminal Style Interface

If global investing is a priority and you want to uncover even lesser-known global stocks then TIKR’s data coverage will surely satisfy.

You’ll have access to over 100,000 global stocks (covering 92 exchanges) to find undervalued future winners for your portfolio.

However TIKR’s user interface might leave you scratching your head if you’re new to investing – or just new to terminal style interfaces. It’s quite complex, and comes with a moderate learning curve.

But if you can process swathes of difficult to interpret text data, TIKR will help you:

- Discover top investor’s trades

- Search for top investors by investment approach

- Know what company execs and board members are buying or selling

- Access income statements, balance sheets, cash flow statements, and more

Advantages

If strong data coverage with over 100,000 global stocks is a must-have for you, then TIKR will deliver.

✅ Stay up to date with news from Reuters

✅ Terminal-style interface similar to Bloomberg

✅ Global data coverage (100,000+ stocks)

Limitations

Terminal style stock research platforms tend to share similar limitations. Mostly, these boil down to not having access to crisp visualizations that help you draw insights from complex information at a glance.

❌ Lacks visualisations and crisp graphics and charts

❌ No AI chatbot or earnings call summaries

❌ Complex interface may be intimidating

❌ No AI-powered insights or analysis

❌ Free tier has delayed data

Pricing

You can access TIKR for free – but data is only available for the US and features are limited. For real time data, greater historical depth, long-range analyst estimates, and access to global data – you will need to upgrade to a paid plan. Pricing ranges up to $39.95/month.

Which FactSet Alternative Is Right for You?

With platforms available at all price points, from Gainify and it’s investing AI connected to Wall Street data available for free, to enterprise tier platforms costing tens of thousands per year – there is something for everyone.

If you’re a financial professional with team collaboration and client interaction needs, then Bloomberg, S&P Global Capital, and AlphaSense will be invaluable for your research and investing workflows. But don’t let that stop you from trying the likes of Gainify and Fiscal.ai for intrinsic value analysis and quick AI insights or to fill gaps left by enterprise-tier tools.

If you’re a retail investor – the choice comes down to interface preferences, AI chatbot experience, and top investor tracking.

- Choose Gainify for: A streamlined interface complete with clean charting to gain insights into true intrinsic value in minutes, and top investor tracking.

- Choose Fiscal.ai for: API integration and unique KPIs & Segments data.

- Choose TIKR for: Terminal style interface similar to Bloomberg.

The proliferation of breakthrough AI stock analysis tools and democratized access to premium Wall Street data means retail investors now enjoy capabilities previously exclusive to enterprise-tier financial institutions.

Frequently Asked Questions

What is the best FactSet alternative for retail investors?

Gainify.io is the best FactSet alternative for retail investors. It provides Wall Street data combined with the platform’s own proprietary valuation methods, AI stock analysis, and access to the world’s most comprehensive analyst estimate database at an affordable price point.

How much does FactSet cost?

Specific pricing is challenging to find. According to Vendr, pricing ranges from $4,200 to $150,000+ per year. Based on data from ten contracts within Vendr’s database, the average investment is $45,000/year.

What is the cheapest alternative to FactSet?

Gainify offers the most affordable alternative with a Starter (FREE) plan providing access to all core features with an unlimited number of stock reports & 10 AI queries per month. Paid plans start at just $10.99/month ($7.99/month billed annually) for the Investor plan, followed by Fiscal.ai (starting at $24/month billed annually) and other higher-priced options.

Which FactSet alternative has the best AI features?

Gainify offers the most comprehensive AI features, including immediate summaries of earnings call transcripts and an AI chatbot connected to Wall Street data and the world’s largest database of analyst estimates.

Do I need multiple platforms for complete stock research?

While enterprise solutions aim to be all-in-one platforms, you will likely find value in pairing complementary tools. For example, pairing Gainify’s AI capabilities and proprietary metrics with AlphaSense’s expert interview data can create a powerful stock research workflow.

Can retail investors access the same quality of data as institutional investors?

Yes. Platforms like Gainify and Fiscal.ai have democratized access to Wall Street data by leveraging the same S&P Global Market Intelligence data used by enterprise platforms. All delivered at retail-friendly price points. Some specialized datasets may remain exclusive to enterprise platforms, however.