When researching a stock, you’ll often come across the term “price target”, which is a central concept in investment analysis and equity research. Understanding what a price target means, how it’s calculated, and how to use it effectively can help you make more informed decisions in the stock market.

In this article, we break down the meaning of price target, how analysts arrive at it, and what it does (and doesn’t) tell you about a stock’s future performance.

What Is a Price Target?

A price target is the projected future price of a stock, typically over the next 12 months, as estimated by an equity analyst or investment firm. It represents the level at which the stock is expected to trade based on the analyst’s assessment of the company’s financials, valuation, and broader market outlook.

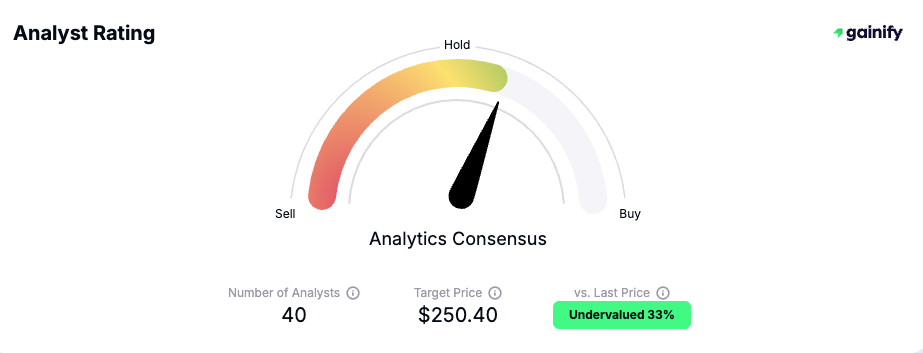

Each brokerage or investment bank typically has its own team of analysts who assign individual price targets to the stocks they cover. These individual forecasts can vary significantly based on the models and assumptions used. When multiple analysts provide price targets for the same stock, a consensus price target is often calculated by averaging their estimates. This consensus serves as a useful benchmark for gauging overall market sentiment.

Key Points:

- Issued by equity research analysts or investment banks

- Consensus price target is derived by averaging multiple analysts’ forecasts

- Usually tied to a 12-month time horizon

- Based on financial modeling and valuation assumptions

Example: How to Interpret a Price Target

As of now, Apple Inc. (AAPL) trades at $188.38, while the consensus 12-month price target stands at $250.40. This suggests a potential upside of approximately 33%.

When many analysts arrive at similar price targets, it can signal a strong consensus about a company’s fundamentals and growth prospects. However, when targets vary significantly, it often reflects divergent views on future earnings, risk exposure, or market conditions.

How Is a Price Target Calculated?

Analysts use a combination of qualitative and quantitative methods to determine a price target. At the core of this process is the development of a detailed financial model for the company. Each analyst builds their own forecast based on:

- Revenue growth projections

- Margin assumptions (gross, operating, net)

- Capital expenditures and cash flows

- Industry trends and macroeconomic inputs

These forecasts feed into various valuation models, including:

- Discounted Cash Flow (DCF) analysis, which estimates the present value of expected future cash flows

- Dividend Discount Model (DDM), often applied to mature, dividend-paying companies. It values a stock based on the present value of its expected future dividend stream.

- Comparable company analysis, where peer firms are used as benchmarks for valuation

- Sum-of-the-parts (SOTP) valuation, often used for diversified or conglomerate businesses

Analysts also incorporate management guidance, industry developments, and recent company performance. The resulting price target reflects not only valuation assumptions but also a judgment on risk, competitive positioning, and market dynamics.

Why Price Targets Matter to Investors

While price targets are not guarantees, they serve as important directional tools that can influence market sentiment and trading decisions. Here’s how they provide value to investors:

- Benchmark Expectations: Price targets offer a baseline for what analysts believe a stock is worth over the next 12 months, helping investors gauge expected upside or downside.

- Aid in Valuation: When compared to a stock’s current price, the target helps frame whether it is perceived as undervalued, overvalued, or fairly priced.

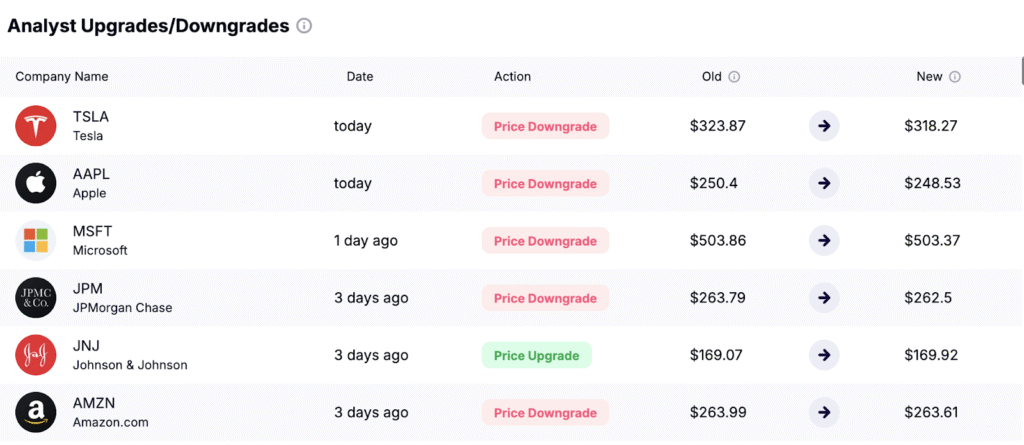

- Catalyst Awareness: Adjustments to price targets often accompany or follow major catalysts such as quarterly earnings, new product launches, management changes, or geopolitical shifts.

- Market-Moving Potential: Revisions from prominent analysts (e.g., Goldman Sachs, Morgan Stanley, JP Morgan) can materially influence short-term price movements, especially if a stock is heavily covered or widely held.

- Consensus Shift Indicators: When multiple analysts begin revising targets in the same direction, it often signals an inflection point in market perception and may lead to broader investor repositioning.

Limitations of Price Targets

Despite their popularity and influence, price targets have meaningful limitations that investors should consider:

- Subjective Inputs: Price targets rely heavily on assumptions made by analysts, including revenue projections, margin expectations, and valuation multiples. These assumptions can vary widely between firms.

- Market Volatility: External shocks such as geopolitical conflicts, policy changes, or surprise economic data can quickly invalidate even the most well-reasoned price target.

- Short-Term Horizon: Most price targets focus on a 6 to 12-month time frame, which may not align with long-term investment goals or structural trends.

- Conflicting Views: Multiple analysts can have dramatically different price targets for the same stock, often driven by different methodologies, sector views, or risk appetites.

- Lagging Revisions: Price targets are not always updated in real-time. Analysts may delay revisions following earnings releases or market-moving news, making targets stale or less relevant.

- Psychological Anchoring: Investors can become anchored to a specific target and overlook deteriorating fundamentals if the number remains unchanged.

Always consider the full range of analyst estimates and the rationale behind each projection. Use price targets as one of many inputs (not a standalone indicator) when making investment decisions.

Where to Find Price Targets

Each major brokerage or investment bank typically has its own team of equity analysts who assign individual price targets to the stocks they cover. These estimates are based on internal research models, sector expertise, and economic forecasts. When several analysts cover the same stock, a consensus price target (an average of all available projections) is commonly used to gauge broad sentiment.

In addition to traditional sources, modern equity research platforms make it easier than ever to access and interpret price targets from across the market.

You can find individual and consensus price targets on:

- Brokerage platforms (e.g., Fidelity, Schwab, E*TRADE)

- Financial media (e.g., CNBC, Bloomberg, MarketWatch)

- Research aggregators (e.g., Yahoo Finance, TipRanks, Seeking Alpha)

- Equity research platforms (e.g., Gainify, FinChat, Simply Wall St)

- Analyst reports issued by investment banks and institutional research teams

Final Thoughts

A price target is a valuable reference point, but not a guarantee. It reflects an analyst’s informed projection based on their financial modeling, assumptions, and market outlook. While it can help shape expectations, it should always be viewed within the broader context of investment analysis.

Consensus price targets, in particular, can offer useful insight into collective analyst sentiment. When multiple professionals converge around a similar forecast, it often signals confidence in a stock’s direction. Conversely, large disparities between analyst targets may reflect uncertainty or disagreement about a company’s outlook.

Ultimately, price targets should be treated as one tool among many. Combine them with fundamentals, technicals, macro trends, and your own risk profile to make fully informed investment decisions.