If you’re hunting for a powerful stock research platform, ValueInvesting.io has likely caught your attention. It boasts comprehensive valuation tools, which will be appealing if you want to replicate the success of value investing greats like Warren Buffett and Charlie Munger. However, it’s worth exploring alternatives to find the stock analysis tool that fits your investing style best.

You might be seeking alternatives to ValueInvesting.io for a number of reasons – perhaps you’re seeking accessible pricing without regional restrictions, intuitive visualizations, AI-powered research tools, or specific features like top investor tracking. Whatever your reason, this guide will help you find the platform that best matches your personal investing approach. We’ll explore six top ValueInvesting.io alternatives for retail investors in 2025.

About ValueInvesting.io

ValueInvesting.io offers valuation tools for fundamental analysis. You’ll find multiple valuation tools including DCF (Discounted Cash Flow, a method that estimates a company’s value based on projected future cash flows), Trading Multiples, Peter Lynch Fair Value, Earnings Power Value, and Dividend Discount Models.

Company and stock data you will find within ValueInvesting.io includes:

- Institutional and congressional ownership tracking

- ESG ratings and financial health indicators

- Historical price data and benchmarking

- Probability of bankruptcy calculations

- Financial statements and metrics

- Dividend history and forecasts

One of ValueInvesting.io’s standout features is its detailed WACC (Weighted Average Cost of Capital, which shows how much a company pays to finance its assets) calculations. It helps you understand a company’s capital structure and cost of financing – a feature not often found in other stock analysis platforms.

Advantages

ValueInvesting.io offers some strong advantages for retail investors:

✅ Multiple valuation methodologies for thorough analysis

✅ Detailed ownership tracking for institutional investors and Congress members

✅ Comprehensive solvency analysis with bankruptcy probability

✅ Professional interface with data-rich displays

✅ Extensive financial statement analysis

Limitations

Despite its strengths, ValueInvesting.io does have some limitations to consider:

❌ Visualization tools are very limited

❌ Free plan limited to S&P 500 companies

❌ AI features sometimes experience loading issues

❌ Regional coverage requires separate subscriptions

❌ Interface may present a steep learning curve for beginners

Pricing

ValueInvesting.io offers a free plan with access to S&P 500 companies, but global coverage requires regional subscriptions. The more regions you want to access, the more expensive it will be (19.99/mo per region). Regions include the United States & Canada, Europe, Asia/Pacific and Latin America & Africa. Other stock research platforms (like Gainify) give you access to data from all regions in their base subscription.

Alternative 1: Gainify — Best for AI-Powered Research and Analyst Estimates

Gainify connects you to real-time Wall Street data (from S&P Global Intelligence) and powerful AI analysis tools – including Gainify’s breakthrough AI chatbot stock analysis assistant, and earnings call summaries. Its user-friendly interface – complete with useful data visualizations – speeds up complex financial analysis, making it easier for you to gain deep insights into a stock’s intrinsic value. You’ll be able to make confident, data-backed investing decisions with access to:

- AI-powered analysis tools that provide instant insights and earnings call summaries

- The world’s largest analyst estimate database for retail investors, including historical accuracy tracking

- Top investor and congressional trading data with portfolio comparison tools

- Proprietary metrics focused on predicting future value

- Pre-built and customizable screeners to quickly find investment opportunities

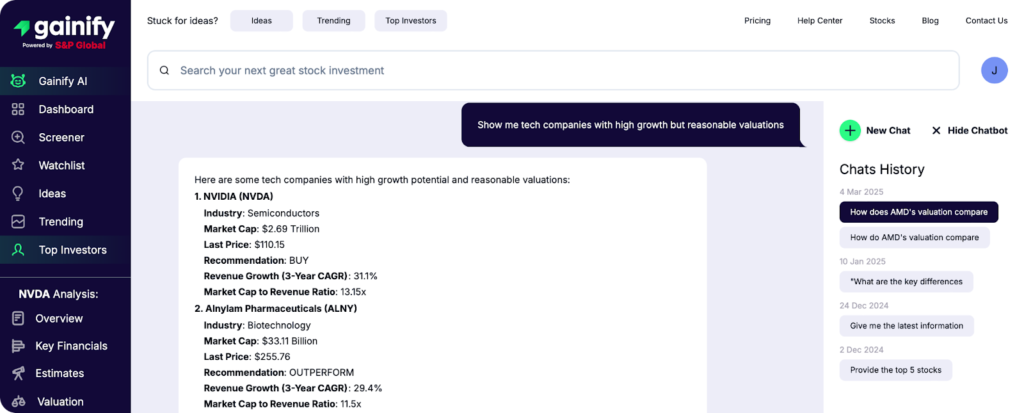

The biggest game changer for your stock research process will likely be Gainify AI and its chatbot & earnings call analysis. Unlike generic AI tools trained on outdated information, Gainify’s assistant is built for investors by investors – it’s like having your own personal stock analyst available 24/7.

Ask Gainify AI to research & analyze investment questions that would normally take hours to research manually, like:

- “What is Gainify’s view on Tesla’s current valuation?”

- “Compare Palantir and Crowdsrike based on forward P/E and growth potential”

- “Who are the top three players in the semiconductor industry and how do they compare?”

- Analyze the latest earnings call for Adobe and highlight key risks

- “Show me tech companies with high growth but reasonable valuations”

Whether its competitor comparisons, industry deep dives, earnings call analysis, or valuation insights that you’re seeking – Gainify AI will cut your research time in half.

Try these or similar queries for yourself with a free Gainify account!

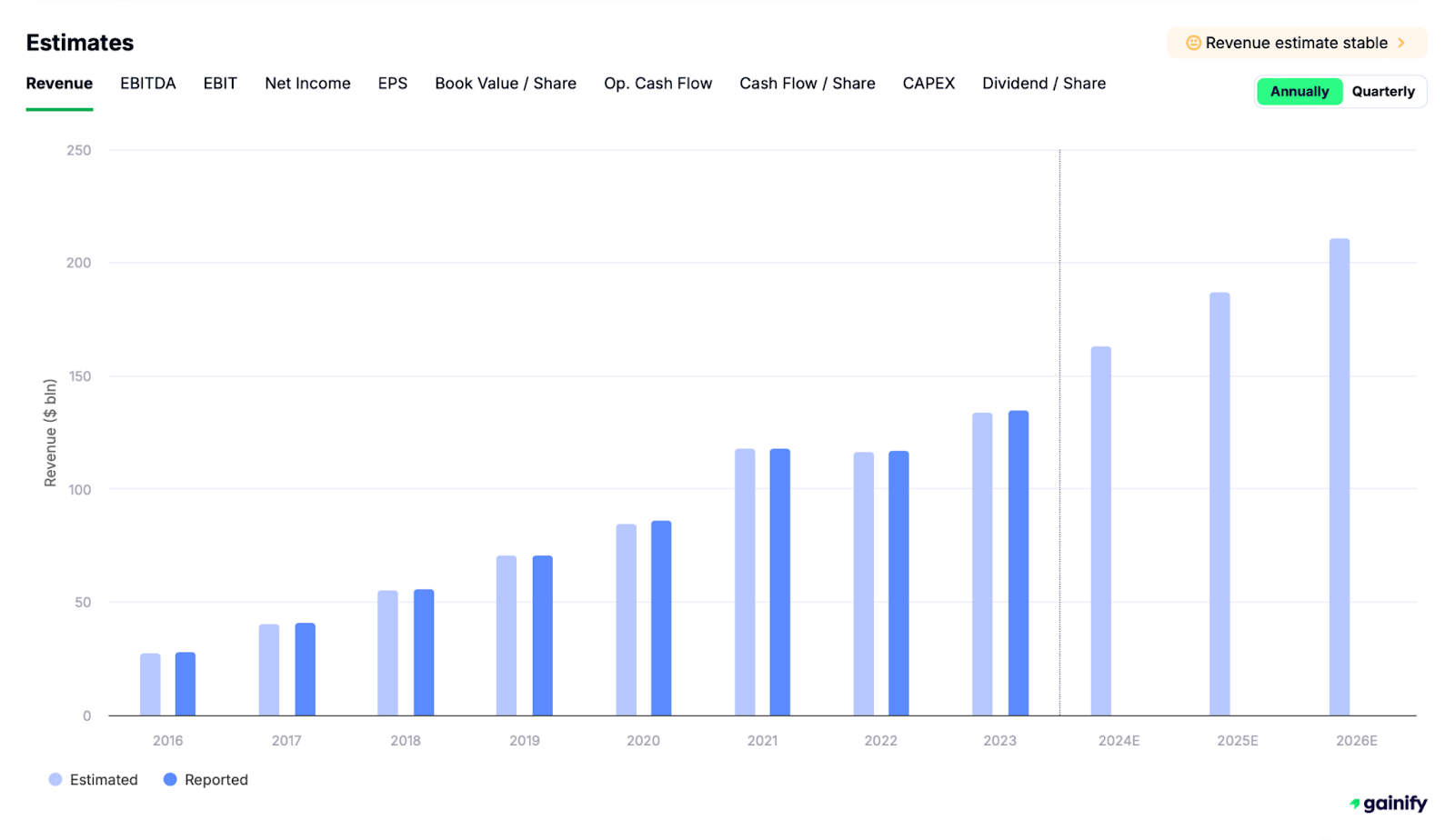

Analyst Estimates and Proprietary Valuation Metrics

When you’re researching a stock’s potential, you need a complete picture with both historical context and future projections – not just price charts. Gainify provides you with:

- 3-year forward projections for key metrics

- Up to 15 years of historical analyst estimate data

- Visually intuitive charts showing you how estimates have evolved

These tools help you understand not just current valuations, but also how a company’s valuation has developed over time (and importantly, where it might be headed in the future).

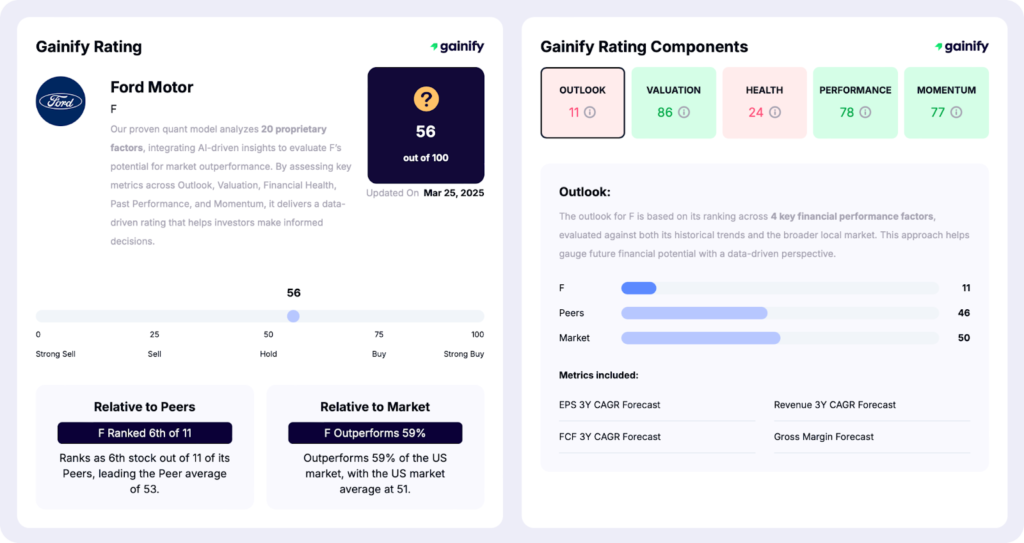

You’ll also gain full access to proprietary Gainify metrics for Performance, Momentum, Valuation, Outlook, and Health.

Performance evaluates management’s ability to consistently deliver tangible results for investors (growth and shareholder value). Calculated based on execution over the past five years.

Momentum helps you identify whether recent performance (positive or negative) is likely to continue in the near future. Calculated based on three separate price-movement indicators.

Valuation enables you to put current pricing in proper context, showing whether a stock is undervalued, fairly priced, or overvalued. Calculated using five essential indicators, and by comparing a stock to both its own historical valuation and broader market benchmarks.

Outlook helps you understand not just how a company is performing now, but where it’s likely headed. Calculated based on four key financial forecasts relative to both industry peers and the broader market.

Health provides you with insights into a company’s ability to weather economic downturns and meet long-term obligations. Particularly valuable for assessing downside risk in your potential investments.

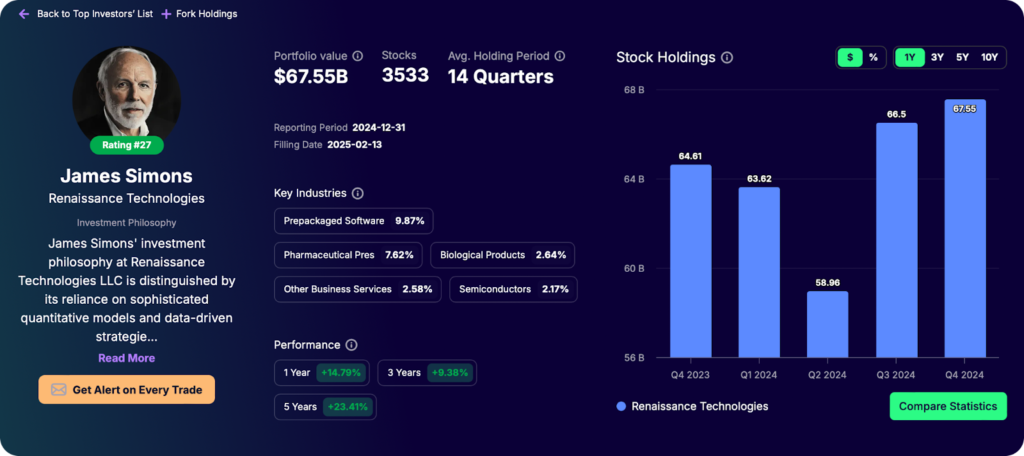

Top Investor Tracking

With Gainify’s top investor tracking features, you’ll gain unprecedented visibility into the moves of the stock market’s most successful players.

- View the latest trades from top investors like Warren Buffett, David Tepper, and others

- Compare portfolios head-to-head to identify patterns and top performers

- Copy portfolios to your watchlist with a single click

- Track Congress insider trading activity

Top investor tracking is helpful for uncovering investing ideas you might have missed, seeing which industries top investors are moving into (our out of), or double checking to see if top investors are buying or offloading a stock you were interested in.

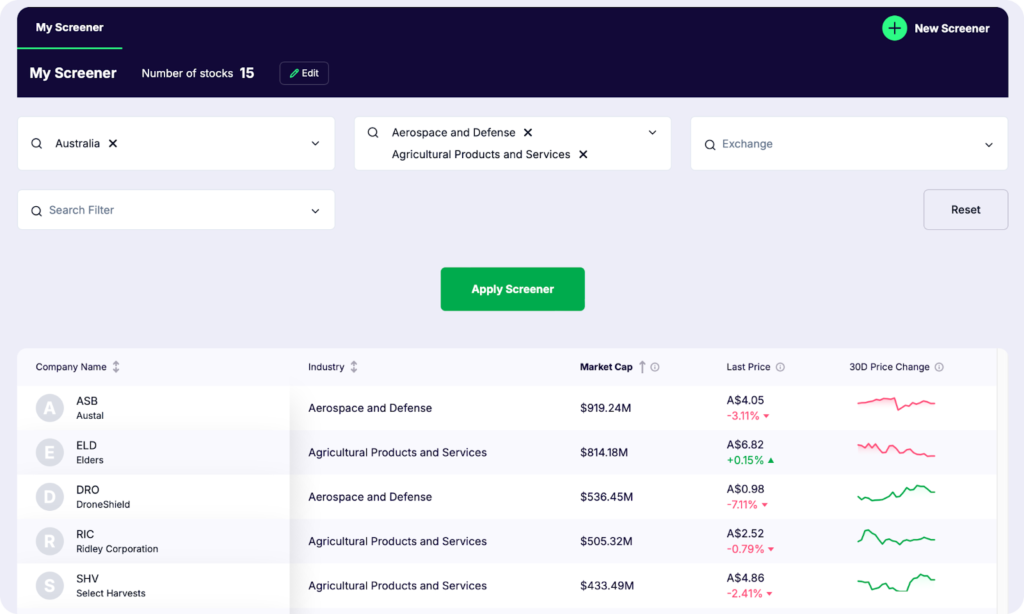

Stock Screeners

Gainify’s stock screening capabilities provide you with multiple approaches to finding your next winning investment.

The “Ideas” section gives you immediate access to pre-built stock screeners regularly updated with fresh opportunities. Ready-to-use screeners cover key industry sectors like semiconductors, AI, quantum computing, space exploration, nuclear energy, cybersecurity, and more.

You’ll also find pre-built screeners based on investment strategies and fundamental criteria. These include:

- Cash cows with strong free cash flow

- dividend champions for income investors

- companies in a pivot year poised for transformation

- stocks with the highest Gainify ratings or analyst consensus

When you need more specific results, Gainify’s customizable screener enables you to combine filters across global regions, individual stock exchanges, and over 150 industries. Refine your search using filters and ranges for 370+ financial metrics for extremely targeted screening based on your investment criteria.

Advantages

Gainify offers numerous advantages for retail investors seeking AI enhanced stock research combined with intuitive visualizations and gold standard stock data:

✅ AI-powered tools connected to Wall Street data from S&P Global Intelligence

✅ Proprietary Gainify metrics focused on future value

✅ User-friendly interface with intuitive visualizations

✅ Top investor and congressional trading tracking

✅ Pre-built and customizable stock screeners

Limitations

While Gainify offers comprehensive stock research capabilities, it does have some limitations.

❌ No direct broker integration for trading

❌ Limited technical analysis tools

❌ No Excel export functionality

Pricing

Gainify has three main pricing levels.

- Starter (FREE – No credit card required): 10 AI queries/month, 1 year of forward estimates, unlimited watchlists, and access to 30 global exchanges.

- Investor ($10.99/month or $7.99/month annually): 50 AI queries/month, 3 years of forward estimates, 10 years of multiple development history, unlimited stock reports.

- Gainer Pro ($36.99/month or $26.99/month annually): 500 AI queries/month, 3 years of forward estimates, unlimited stock reports, and 15 years of multiple development history.

Unlike ValueInvesting.io’s regional subscription approach, Gainify gives you access to its full feature set across global markets. There’s no need to pay extra for each global region.

Alternative 2: Simply Wall St — Best for Visual Analysis

For visual learners who prefer graphics over dense numerical tables, Simply Wall St offers an intuitive approach to fundamental analysis. The platform’s signature “Snowflake” visualization – along with other visual analysis tools – transforms complex financial data into easy-to-understand graphics.

You’ll get comprehensive coverage of over 120,000 stocks across 90 global markets, all available without regional restrictions.

With Simply Wall St, you’ll benefit from:

- Snowflake visualization that analyzes companies across five dimensions: value, future, past, health, and dividends

- Easy-to-interpret charts for income statements, balance sheets, and cash flows

- Management profiles with information on compensation, tenure, and share ownership

- Broker integration for portfolio syncing

- Visual company comparisons for side-by-side analysis

Advantages

Simply Wall St offers several key advantages, particularly for visual analysis.

✅ Extensive global coverage

✅ Clean, modern interface

✅ Broker integration for portfolio tracking

✅ Intuitive visual approach to fundamental analysis

✅ Management profiles with insider transaction data

Limitations

Despite its visual strengths, Simply Wall St does have some limitations. For example, if you’re seeking AI tools to speed up your stock research, you will need to look elsewhere.

❌ Annual-only billing for paid plans

❌ No AI-powered research capabilities

❌ Limited customization for advanced investors

Pricing

Simply Wall St offers three pricing tiers: Free, Premium, and Pro. The latter two being paid plans. Unfortunately, if you need access to paid plan features, you will need to pay for a full year – there are no monthly plans. Paid plans cost up to $239.88/year.

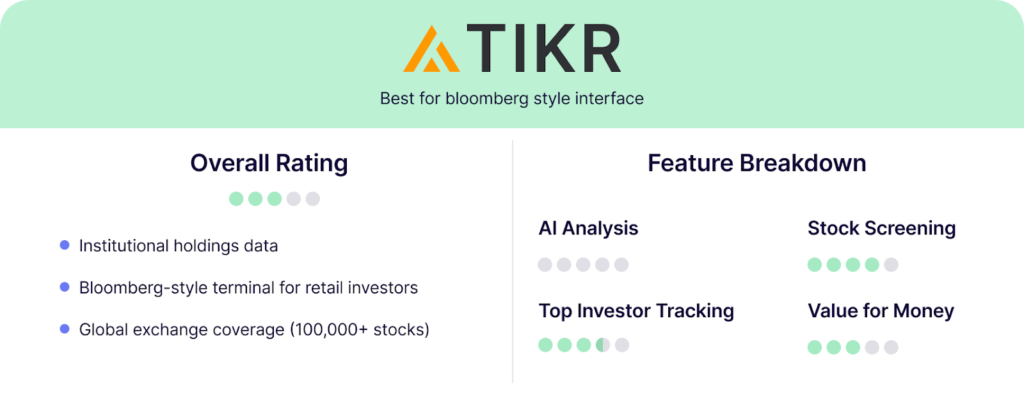

Alternative 3: TIKR — Best for Terminal-Style Research with Global Coverage

TIKR offers a Bloomberg-inspired terminal experience – providing you with data on over 100,000 stocks across 92 countries (136 exchanges).

If you appreciate ValueInvesting.io’s terminal-style interface but want more affordable global coverage (TIKR doesn’t charge you extra for each global region like ValueInvesting.io does) then TIKR is a compelling alternative.

With TIKR, you’ll get access to:

- Global stock data coverage across 92 countries

- Reuters news integration for real-time updates

- Institutional investor tracking with portfolios of over 10,000 funds

- Comprehensive financial statements with up to 20 years of historical data

- Custom screeners with hundreds of filtering options

Advantages

TIKR offers several significant advantages, especially when it comes to the latest stock news and trusted stock data.

✅ Reuters news integration

✅ Extensive global coverage

✅ Institutional portfolio tracking

✅ Professional terminal-style interface

✅ Data powered by S&P Global CapitalIQ

Limitations

While powerful, TIKR does have some limitations to consider. A text and numerical data-heavy interface may be overwhelming and come with a steep learning curve. Uncovering insights in the terminal style interface requires deep extended concentration and mental effort.

❌ Text-heavy interface may be challenging for beginners

❌ Free tier limited to US stocks with delayed data

❌ No AI-powered insights or analysis

❌ Limited visualization tools

Pricing

TIKR’s pricing structure is straightforward – Free, Plus ($19.95/month), and Pro ($39.95/month). The Free plan is limited to US stock data only. Paid plans give you access to global stock data, and deeper financial history.

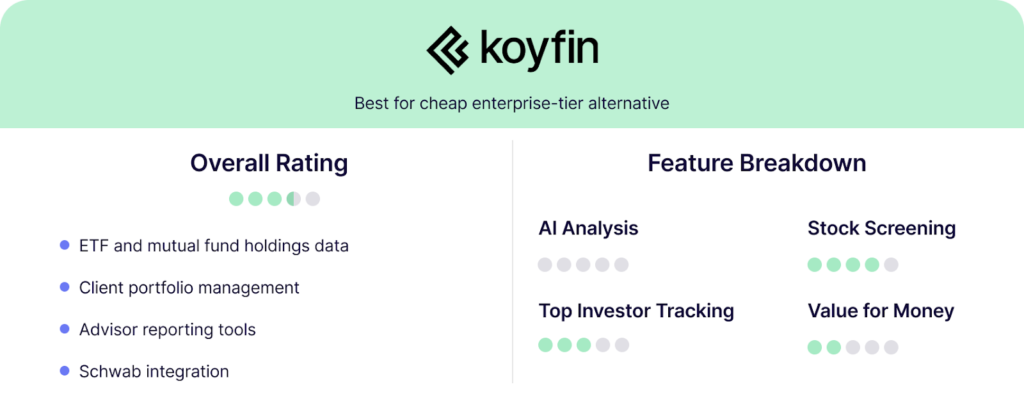

Alternative 4: Koyfin — Best for Multi-Asset Research

Koyfin stands out for its multi-asset coverage and professional-grade features at a relatively accessible price point. If you need to analyze stocks alongside bonds, ETFs, commodities, and currencies, Koyfin provides a comprehensive solution.

You’ll find a terminal-style interface with powerful customization options, making it particularly valuable if you maintain diverse portfolios.

With Koyfin, you’ll benefit from:

- Multi-asset coverage including stocks, bonds, ETFs, commodities, and currencies

- Client portfolio management tools for financial advisors

- Advanced charting capabilities with extensive customization

- Macro and micro economic data integration

- Schwab integration for automatic portfolio data syncing

Advantages

Koyfin offers several distinct advantages, especially if you’re seeking macro economic analysis or professional client management tools.

✅ Macro economic analysis tools

✅ Hotkey support for power users

✅ Comprehensive multi-asset coverage

✅ Professional tools for financial advisors

Limitations

Koyfin does have some limitations to consider, however. Its enterprise-tier feel comes with a steeper learning curve and higher pricing.

❌ Limited features in the free plan

❌ No AI-powered research capabilities

❌ Higher pricing than some alternatives

❌ Steeper learning curve than visual platforms

Pricing

Koyfin offers three main pricing tiers for retail investors: Free, Plus ($49/month), and Pro ($110/month). But if you are a finance professional who needs client management features, there is also the Advisor Pro ($199/month) tier.

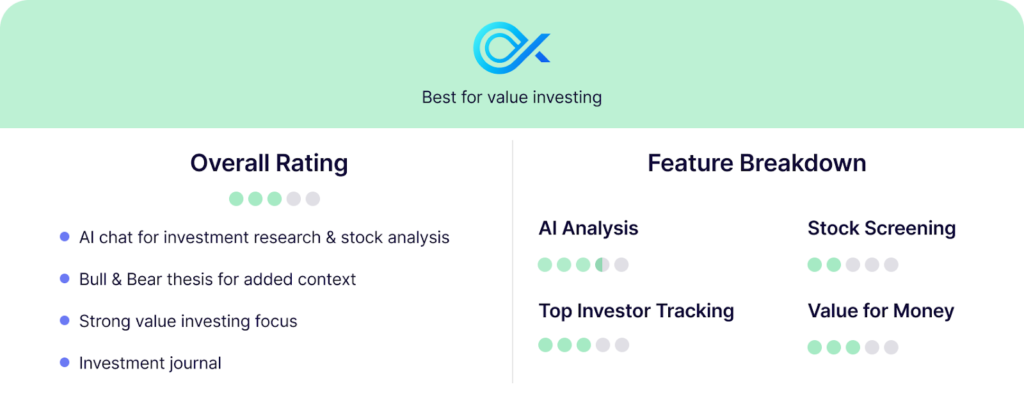

Alternative 5: Alpha Spread — Best for Value Investing Focus

Alpha Spread is designed with value investors in mind, with tools focused on uncovering intrinsic value and identifying undervalued opportunities. The platform offers pre-built screeners based on value investing principles, making it easy to find stocks that match your value investing criteria.

If you appreciate ValueInvesting.io’s focus on fundamental analysis but want a more streamlined approach with enhanced AI chat features, Alpha Spread will be an appealing alternative.

With Alpha Spread, you’ll gain access to:

- Pre-built value investing screeners for criteria like “Sensibly Priced Quality” and “Significantly Undervalued”

- Bull & Bear case analysis to understand different valuation perspectives

- Economic moat analysis to assess competitive advantages

- Investment journal for documenting theses and outcomes

- AI chatbot for stock analysis questions

Advantages

Alpha Spread offers several notable advantages, providing the same value investing focus of ValueInvesting.io but in a clean and easy to use interface with more data visualizations and less raw numerical data.

✅ Strong focus on value investing principles

✅ Investment journal for tracking decisions

✅ AI chatbot for analysis assistance

✅ Simple, straightforward interface

✅ Price target alerts

Limitations

Despite its value investing focus, Alpha Spread has some limitations. One main concern is that Alpha Spread does not confirm from which source they obtain their data. Nor can it be verified whether the data is real time or not. Other platforms like Gainify are backed by real-time S&P Global Intelligence data for confident investing.

❌ Primarily focused on US stocks

❌ Data source transparency concerns

❌ Free plan restricted to just 3 stocks per week

Pricing

Alpha Spread offers a limited Free plan, and paid plans costing $12/month (analyze 15 stocks per week) and $20/month (unlimited stock analysis).

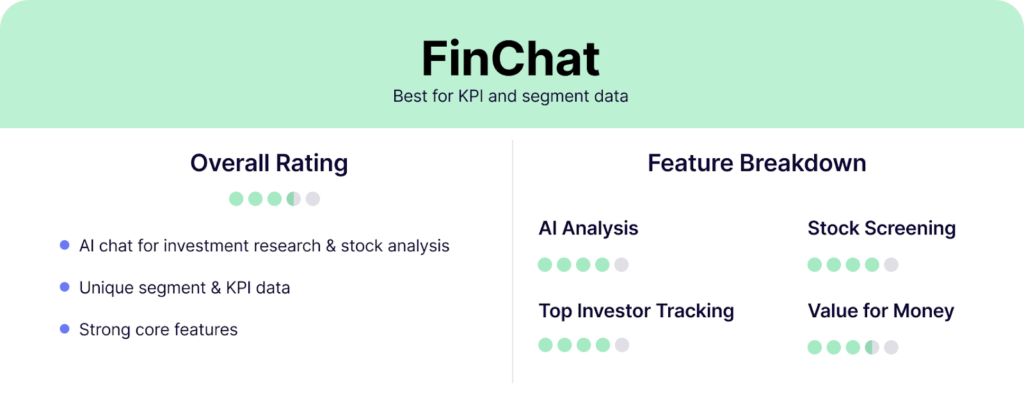

Alternative 6: Fiscal.ai — Best for KPI and Segment Data

Fiscal.ai (formerly FinChat) differentiates through its focus on granular company KPIs and segment-specific data. If you want to dig deep into company-specific metrics like subscription numbers, user growth, or revenue by business segment, Fiscal.ai provides valuable insights not easily found elsewhere.

You’ll also find powerful API integration options if you’re a developer wanting to build custom research workflows – and white label solutions if you’re seeking to integrate Fiscal.ai into your own app or dashboard.

With Fiscal.ai, you’ll benefit from:

- Detailed KPI data including subscribers, active users, and other company-specific metrics

- Segment revenue breakdowns to understand business unit performance

- AI copilot for answering research questions

- API integration for custom workflows

- White-label solutions for businesses

Advantages

Fiscal.ai offers several unique advantages, chiefly its KPI and segment data insights, which many stock research platforms do not offer.

✅ AI chatbot for research

✅ Customizable dashboards

✅ Developer-friendly API access

✅ Advanced stock screener with 300+ metrics

✅ Granular KPI insights not available elsewhere

✅ Extensive financial history with up to 20 years of data

Limitations

Fiscal.ai does have some limitations to consider, however.

❌ No broker integration for trading

❌ No mobile app currently available

❌ Higher pricing than some alternatives

Pricing

Fiscal.ai offers three pricing tiers – each upgrade providing deeper financial data. The Free tier provides basic feature access with 5 years of financial data. The Plus tier ($29/month) gives you 10 years of financial data and unlocks access to analyst estimates. The Pro tier ($79/month) provides you with extensive 20 years of stock history, and unlocks analyst estimate revisions & full KPI history.

Final Thoughts: Which ValueInvesting.io Alternative Is Right for You?

While ValueInvesting.io provides powerful valuation tools with multiple methodologies, the alternatives covered in this article offer unique strengths that may better align with your specific needs. Keep in mind that there may not be only one platform for you – you might find value in using complementary platforms to leverage the best of each. For example, Koyfin’s macro-economic data combined with Gainify’s breakthrough AI stock research tools.

The best alternative to ValueInvesting.io depends on your specific investment approach, data needs, and experience level.

- Choose Gainify for: AI-powered research with analyst estimates. You’ll get the most accessible platform with AI tools connected to Wall Street data, giving you full feature access even on the free tier.

- Choose Simply Wall St for: Visual learning and intuitive interfaces. If you prefer graphics over tables, the Snowflake visualization makes complex financial data easy to understand at a glance.

- Choose TIKR for: Terminal-style research with broad global coverage. You’ll get extensive data across 92 countries without regional paywalls, powered by S&P Global CapitalIQ.

- Choose Koyfin for: Multi-asset portfolios beyond stocks. You’ll benefit from comprehensive coverage of stocks, bonds, ETFs, commodities, and currencies in a customizable interface.

- Choose Alpha Spread for: Pure value investing focus. You’ll get pre-built value screeners and an investment journal to document your thesis and outcomes.

- Choose Fiscal.ai for: Granular KPI and segment data. You’ll gain unique insights into company-specific metrics and business unit performance that other platforms may not track.

The investment research landscape continues to evolve in 2025. Most notably, AI-powered tools are increasingly democratizing access to institutional-grade insights previously unavailable to retail investors (or prohibitively expensive). Whether you prioritize accessible pricing, visual interfaces, global coverage, AI tools, or specialized data – there’s a platform to match virtually any investment style or research preference.

Frequently Asked Questions

What is the best free alternative to ValueInvesting.io?

Gainify’s free plan offers the most comprehensive feature access among alternatives, including AI analysis, top investor tracking, and key valuation metrics. Unlike ValueInvesting.io’s regional restrictions, you’ll get access to global stocks even on the free tier, with limits only on usage frequency.

Which platform has the most powerful AI capabilities?

Gainify offers the most advanced AI implementation, with its chatbot connected directly to S&P Global Intelligence data and automated earnings call summaries. While ValueInvesting.io does offer AI features like Filings Search and Copilot, you may experience occasional performance issues.

Is there an alternative with more global coverage without regional paywalls?

Both TIKR (100,000+ stocks across 92 countries) and Simply Wall St (120,000+ stocks across 90 markets) offer extensive global coverage without ValueInvesting.io’s regional subscription requirements. This makes them more cost-effective if you’re researching international opportunities.

Which platform is best for visual analysis instead of data tables?

Simply Wall St offers the most visually intuitive approach, with its signature Snowflake visualization and graphical representations of financial data. This makes it particularly valuable if you process information more effectively through visuals rather than dense numerical tables.

Can I track institutional investors and Congress members with these alternatives?

Gainify offers the most comprehensive tracking of both institutional investors and congressional trading activity, with the ability to compare portfolios and copy them to your watchlist. TIKR also provides institutional portfolio tracking but with less emphasis on congressional activity.

Which platform offers the best value for money?

Gainify provides the strongest value proposition by giving you access to its full feature set with usage limits rather than feature restrictions, even on the free tier. If you need unlimited usage, its paid plans start at just $7.99/month (billed annually), significantly less than most alternatives while providing access to global markets and gold-standard stock market data from S&P Global Intelligence.