As digital advertising continues to evolve, AdTech stocks are becoming increasingly attractive to investors. These companies power everything from programmatic advertising to mobile app monetization, connected TV, and ad verification. Whether you’re a growth investor or just curious about the future of advertising technology, here are the top publicly traded AdTech companies to keep an eye on in 2025.

✅ 1. Alphabet Inc. (GOOG & GOOGL)

Brief Business Model:

Alphabet is the parent company of Google and a dominant force in digital advertising. It generates most of its revenue through ad platforms like Google Search, YouTube, and the Display Network.

Core AdTech Products:

Google Ads, AdSense, YouTube Ads

Client Base & Partnerships:

Global advertisers, publishers, SMBs, and enterprises

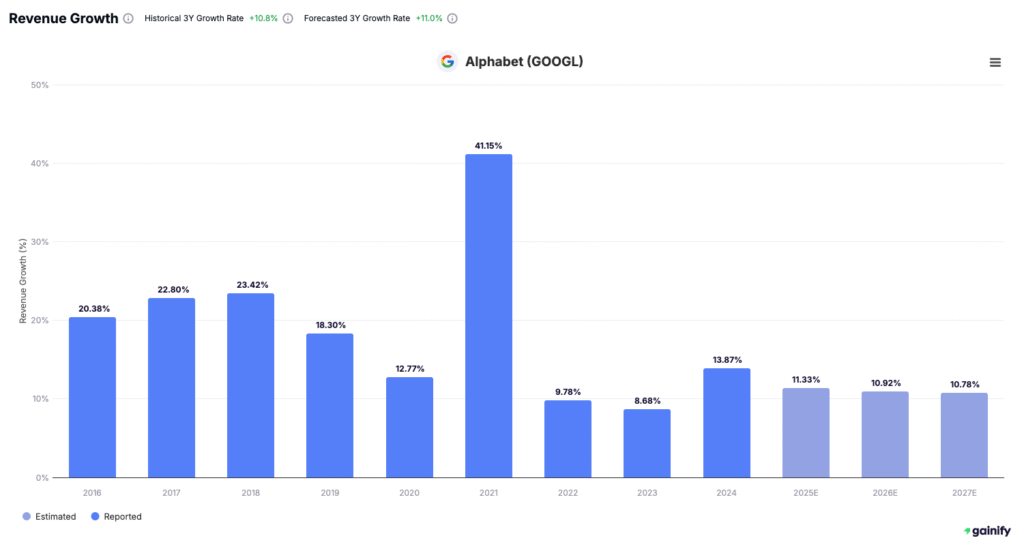

Revenue CAGR Last 3 Years: 10.8%

📌 Why It’s Important:

Alphabet remains a cornerstone in the AdTech landscape due to its unparalleled global scale, sophisticated use of artificial intelligence in ad targeting, and seamless integration across platforms like Search, YouTube, and Android. Its dominance in both search and display advertising provides strong competitive advantages and robust revenue streams.

However, the rise of large language model (LLM)–based search tools presents a potential long-term risk to Google’s core ad business, as user behavior may shift away from traditional keyword-based queries. Investors should monitor how Alphabet adapts its monetization strategies in an evolving search ecosystem.

✅ 2. Meta Platforms Inc. (META)

Brief Business Model:

Meta, formerly Facebook, monetizes its social platforms through targeted digital advertising. It owns Facebook, Instagram, and WhatsApp – some of the most-used platforms globally.

Core AdTech Products:

Meta Ads Manager, Facebook Audience Network

Client Base & Partnerships:

Marketers, influencers, and businesses across sectors

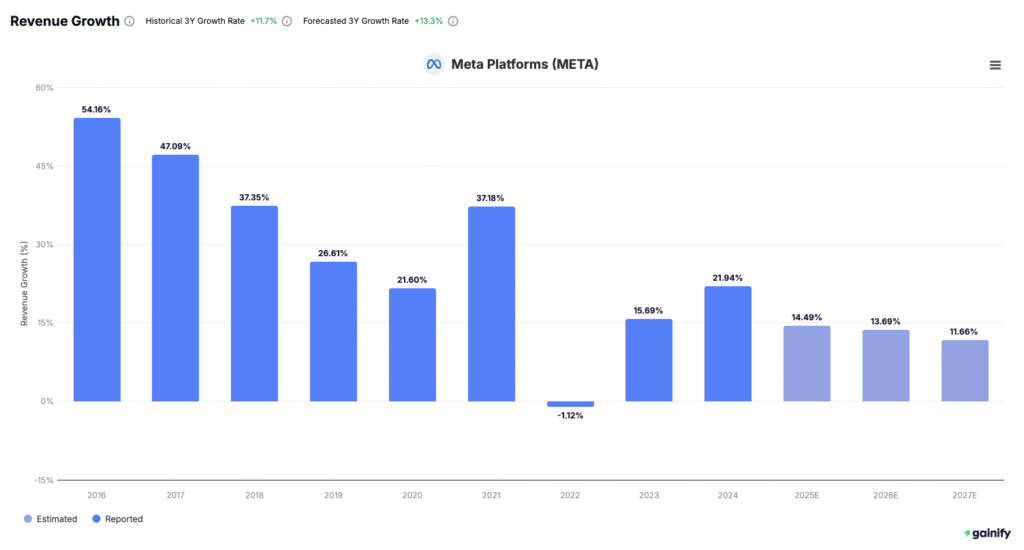

Revenue CAGR Last 3 Years: 10.8%

📌 Why It’s Important:

Meta continues to lead the social AdTech space, leveraging its vast user base and advanced audience targeting capabilities across platforms like Facebook, Instagram, and WhatsApp. Its proprietary data and AI-driven ad optimization give it a significant edge in delivering highly personalized and performance-driven advertising at scale.

That said, Meta faces increasing regulatory scrutiny around user privacy and data usage, as well as growing competition from emerging platforms and short-form video trends. Its long-term success will depend on its ability to innovate within tighter regulatory frameworks while maintaining user engagement and advertiser ROI.

✅ 3. The Trade Desk Inc. (TTD)

Brief Business Model:

The Trade Desk is an independent demand-side platform (DSP) that enables advertisers to programmatically buy digital media across devices.

Core AdTech Products:

The Trade Desk Platform, Solimar

Client Base & Partnerships:

Agencies, global brands, and media buyers

Revenue CAGR Last 3 Years: 26.9%

📌 Why It’s Important:

The Trade Desk is a top choice among programmatic advertisers, known for its transparent, data-driven approach and strong positioning in the rapidly growing connected TV (CTV) market. Its platform, including the Solimar interface, empowers advertisers to optimize campaigns across channels with real-time insights and precision targeting. A 26% year-over-year revenue growth reflects strong execution and expanding demand for independent demand-side platforms.

However, The Trade Desk operates in a highly competitive environment and relies on access to third-party data and evolving identity solutions post-cookie. Continued success will hinge on the company’s ability to innovate in a privacy-first landscape and maintain advertiser trust amidst shifting regulatory and industry standards.

✅ 4. AppLovin Corp. (APP)

Brief Business Model:

AppLovin operates a comprehensive mobile advertising and app monetization platform that helps developers acquire users, optimize ad revenue, and scale their apps. The company combines its in-house machine learning engine with a suite of tools for user acquisition, real-time bidding, and ad placement.

Core AdTech Products:

AXON (machine learning engine), AppDiscovery, MAX

Client Base & Partnerships:

Mobile developers and app publishers

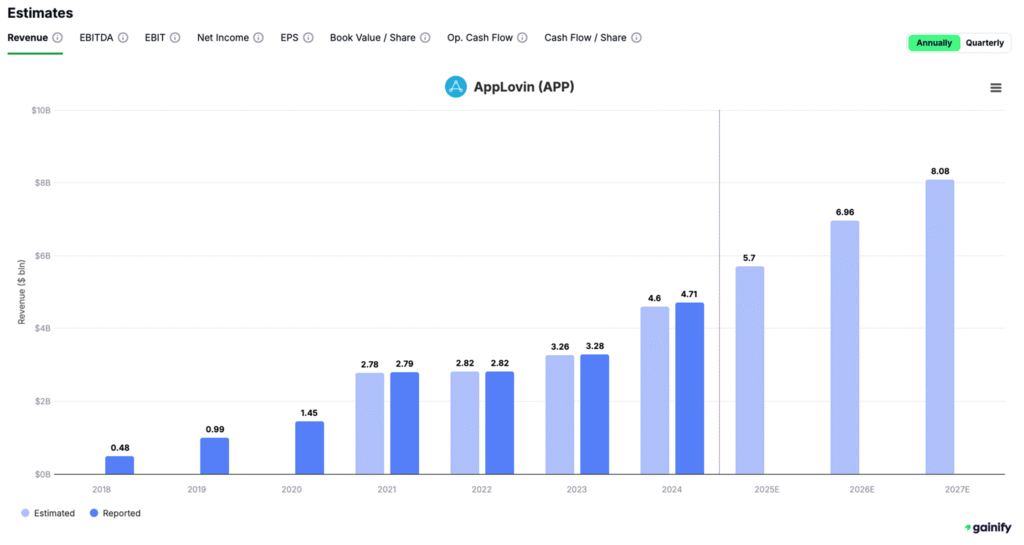

Revenue CAGR Last 3 Years: 19.0%

📌 Why It’s Important:

AppLovin is experiencing rapid growth, fueled by the global surge in mobile advertising and the increasing use of machine learning to drive campaign efficiency, targeting precision, and return on ad spend. Its ability to leverage first-party data and AI-based optimization gives it a strong competitive edge in the performance marketing space.

✅ 5. Roku Inc. (ROKU)

Brief Business Model:

Roku operates a connected TV (CTV) platform that generates revenue through advertising, content distribution, and device sales. Its ad-supported streaming ecosystem, including The Roku Channel and OneView ad platform, enables brands to reach viewers directly within the Roku operating system, which powers millions of smart TVs and devices.

Core AdTech Products:

Roku Advertising, OneView (ad platform)

Client Base & Partnerships:

Streaming services, advertisers, agencies

Revenue CAGR Last 3 Years: 14.2%

📌 Why It’s Important:

Roku’s dominant position in U.S. streaming households makes it a natural beneficiary of the ongoing connected TV (CTV) advertising boom. With its expansive user base, proprietary operating system, and integrated ad platform, Roku is well-positioned to capture a growing share of ad budgets shifting from traditional linear TV to streaming. However, key risks include growing competition from smart TV manufacturers and platform rivals like Amazon and Google, potential regulatory scrutiny around data usage and platform practices, and the broader sensitivity of ad revenue to macroeconomic headwinds.

✅ 6. Magnite Inc. (MGNI)

Brief Business Model:

Magnite is a sell-side platform (SSP) that helps publishers sell digital ad inventory, especially in CTV and video.

Core AdTech Products:

Magnite CTV, SpringServe

Client Base & Partnerships:

Publishers, broadcasters, and streaming services

Revenue CAGR Last 3 Years: 13.4%

📌 Why It’s Important:

As CTV ad spend grows, Magnite is well-positioned as a leading independent SSP with strong ties to premium publishers. It stands to benefit from the shift away from linear TV, though risks remain, particularly its reliance on platforms like Roku and Google, exposure to ad market cycles, and competition from larger, integrated players.

✅ 7. Criteo S.A. (CRTO)

Brief Business Model:

Criteo is a global AdTech company specializing in performance marketing and retail media solutions. It helps brands and retailers deliver personalized, data-driven ads by leveraging commerce and shopper data across the open internet.

Core AdTech Products:

Commerce Growth Platform

Client Base & Partnerships:

E-commerce platforms, retailers

Revenue CAGR Last 3 Years: 6.8%

📌 Why It’s Important:

Criteo’s pivot to retail media positions it to tap into one of AdTech’s fastest-growing segments. By leveraging its shopper data and commerce infrastructure, it’s evolving beyond retargeting into a key retail media enabler. Still, it faces challenges like rising competition from Amazon and Google, the phase-out of third-party cookies, and the pressure to scale its newer business lines.

✅ 8. Integral Ad Science (IAS)

Brief Business Model:

IAS provides ad verification and optimization tools that ensure digital ads are viewable, fraud-free, and placed in brand-safe environments.

Core AdTech Products:

IAS Signal, Context Control

Client Base & Partnerships:

Advertisers, agencies, and publishers

Revenue CAGR Last 3 Years: 17.9%

📌 Why It’s Important:

Ad verification is essential for brands seeking transparency, fraud protection, and brand safety in digital advertising. Integral Ad Science (IAS) is a leader in this space, benefiting from the growing demand for trust and accountability as programmatic ad spend expands. However, the company faces risks including competition from peers like DoubleVerify, reliance on platform access, and potential regulatory changes affecting data and measurement.

Final Thoughts: Investing in the Future of AdTech

The advertising technology (AdTech) sector is undergoing a rapid evolution, driven by shifts in consumer behavior, advancements in machine learning, and the ongoing migration of media consumption toward digital channels. From the rise of connected TV (CTV) and the growth of retail media networks, to increased demand for data-driven targeting and ad verification, this ecosystem presents a compelling opportunity for long-term investors.

Companies in this space are not only innovating how ads are bought, sold, and optimized, but are also becoming critical infrastructure within the broader digital economy. Leaders such as The Trade Desk, Roku, Magnite, AppLovin, IAS, and Criteo each offer unique exposure to high-growth areas within programmatic advertising, mobile, measurement, and commerce media.

For investors seeking to capitalize on the structural tailwinds behind digital advertising, allocating across a diversified group of high-quality AdTech players can offer both growth potential and resilience. As with any emerging sector, it’s important to carefully consider the risks ranging from platform dependency to regulatory uncertainty and to conduct thorough personal analysis before investing in any specific stock.