The best stock news apps in 2026 are Seeking Alpha for diverse analysis, Bloomberg for premium insights, Wall Street Journal for corporate reporting, Reuters for unbiased global coverage, Financial Times for economic analysis, Yahoo Finance for accessibility, and Barron’s for institutional-grade research.

But as you’re seeking the latest stock news, you must stay vigilant and keep in mind that stock news and the opinions within are not a replacement for fundamental analysis. Even professional investors battle the cognitive biases that stock news and the emotions it can trigger.

Always cross check what you hear about a stock in the news with actual fundamental stock data.

The importance of this is well highlighted by the “Inverse Cramer” ETF. This ETF aimed (it has since been shut down) to deliver returns opposite to the recommendations of Jim Cramer – founder of TheStreet (now owned by TheMaven) and host of Mad Money with Jim Cramer on CNBC. Simply, if Cramer recommended a stock, the fund would sell that security. If Cramer recommended selling a stock then the fund would actually buy that security. The ETF was created after some noticed what they felt was a trend of bad stock trade recommendations promoted by Cramer, among which include recommending SVB Financial Group just one month before Silicon Valley Bank would collapse, and similar recommendations related to Bear Stearns before the ill-fated bank would crash out in 2008.

We’re not here to bash Cramer – he’s certainly had some success, and is not alone in having some bad stock recommendations to his name – but rather to highlight the risks of betting big based on any one news story or stock recommendation (even if it’s from a reputable source.)

When reading stock news, be wary of:

- Outsourced thinking: Relying on external opinions rather than your own analysis.

- Emotional amplification: Hyping up market events is a great strategy to get people to click on news stories. Don’t let emotional amplification influence your trading.

- Quick narratives: News stories can reduce complex stock data into simplified narratives.

To build your investment immune system and analyze the latest stock news with a grain of salt, you should: Develop fundamental analysis skills using stock research tools like Gainify, separate entertainment from analysis (it’s great to stay up to date with what’s happening in the world but don’t expect reading stock news to replace actual analysis), and practice emotional awareness to understand how your emotions react to fast moving and hyped up stock news.

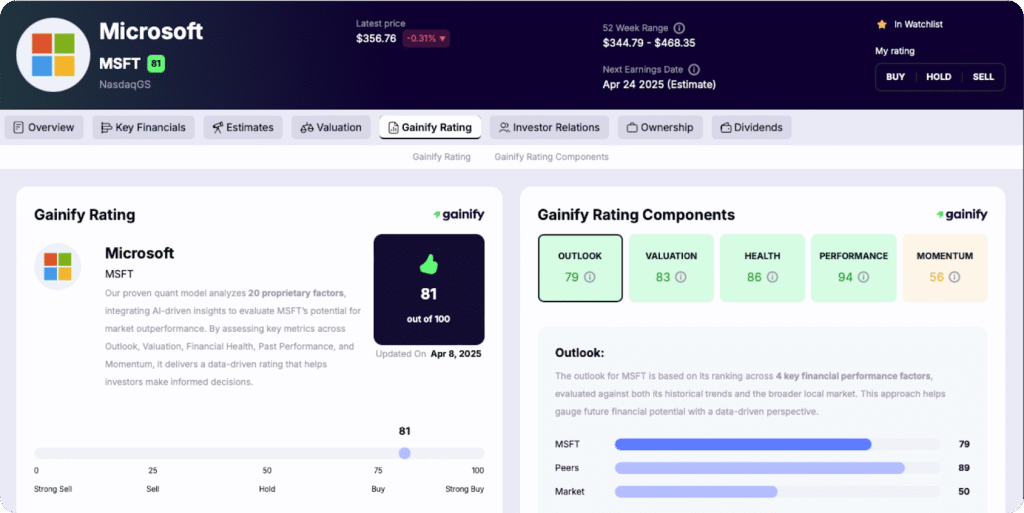

Gainify for uncovering a stock’s intrinsic value

Try out Gainify’s stock analysis – it’s free.

Most financial news focuses on price movements – reporting that a stock rose 3% after earnings or dropped 2% following an FDA announcement. But this surface-level information fails to answer deeper questions that truly matter – what is a stock’s intrinsic value? How does it compare to competitors in the industry? What is the stock’s outlook and what do analyst estimates say about its price target?

With Gainify you’ll be able to validate what you hear and read about stocks and industries. Use the breakthrough AI stock analysis assistant to quickly get answers to your most important investing questions. It’s connected to S&P Global Intelligence data for trusted insights into the world’s top stocks.

Gainify’s AI investing assistant can analyse earnings call transcripts for investing insights, compare top competitors, provide industry reports, and more.

You’ll also have access to:

- The world’s largest database of analyst estimates for retail investors so you can see what Wall Street consensus is for a stock.

- Gainify proprietary metrics focused on future value that cover a company’s 5-year performance, momentum, valuation, outlook, and ability to weather economic downturns.

Other helpful features include top investor tracking to see what the world’s best investors are actually buying and selling (not just what you hear about on the news), and stock screening so you can find stocks that fit your specific investment strategy or thesis.

You can access all these features and more with a free Gainify account.

As Warren Buffett wisely noted, “The stock market is a device for transferring money from the impatient to the patient.” Don’t let the sense of urgency, hype, or fear created from news articles cause you to lose your cool. Remain patient and seek stocks with attractive core fundamentals and strong intrinsic value.

Top Financial News Platforms in 2026

When choosing your go-to stock news app or financial news platform, find a source that aligns with your investment strategy, content consumption preferences, and area(s) of interest.

For example, Seeking Alpha provides crowd sourced news and a newsletter, Barrons offers both retail investor and advisor-focused news along with print publication options, and Bloomberg combines text-based stock market news with podcasts, radio shows, and multiple television ‘channels’. While all are stock news websites, each provides its own angles and unique features.

Continue reading for a detailed comparison of the top financial news sources you can use (in conjunction with stock research platforms) to inform your investment decisions.

1. Seeking Alpha: Best for Diverse Investment Perspectives

Seeking Alpha is a crowd sourced news platform. That means you get diverse perspectives from a range of investors, writers, and analysts.

The company boasts producing over 400 unique articles and news updates daily, giving a voice to over 18,000 analysts. However, much of the ‘News’ section is produced by its India-based editorial team. To find truly crowd sourced analyst perspectives, you will need to visit the ‘Analysis’ section of the website.

News and analysis on Seeking Alpha covers stocks, ETFs, commodities, and macroeconomic trends.

Advantages

- Exposes you to genuinely diverse viewpoints (not algorithmic bubbles)

- Forces confrontation with opposing investment theses

Top features

- Podcast

- Stock and ETF screener

- Ability to create portfolios

- Portfolio health check feature

- Virtual AI analyst reports available for paying subscribers

Pricing

Seeking Alpha can be accessed for free, but access to paid features and professional tools can cost up to $2,400 per year.

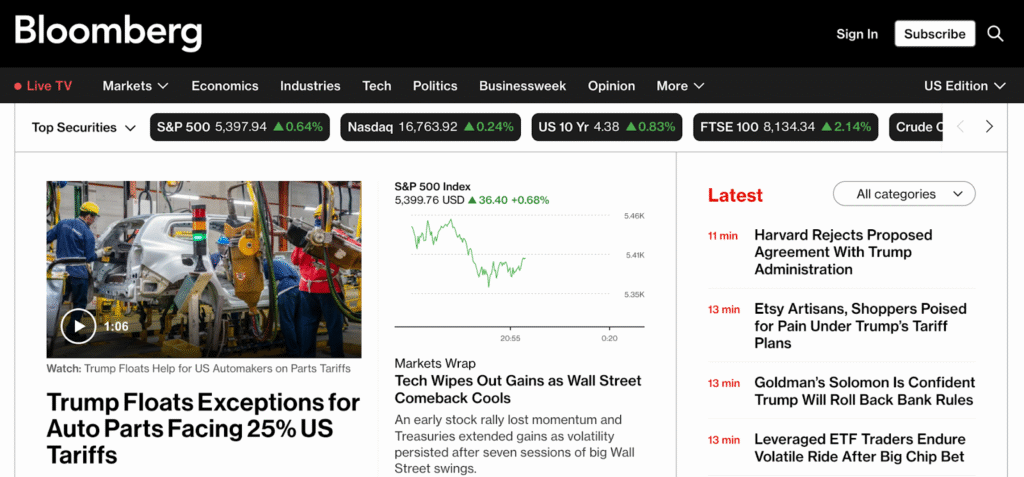

2. Bloomberg: Best for Global Market Intelligence

Bloomberg is one of the better known stock news sources in this comparison. Rather than offering crowd sourced opinions and analysis like Seeking Alpha, it takes an editorial approach. It also tends to emphasize context and explanation over sensationalism.

You’ll find a range of verticals within Bloomberg, including:

- Tech updates

- Opinion pieces

- Market coverage

- Global politics news

- Macroeconomic analysis

- Industry specific coverage

- General business news and commentary

Bloomberg is a well funded high-quality publication offering online articles, television news, dedicated television shows (such as Daybreak Europe and China News), digital podcasts, radio, live events, newsletters, and print editions.

As you can see, there’s not much you can’t find on Bloomberg when it comes to stock news.

Advantages

- Bloomberg graphics provide unique data visualizations to break down complex topics

- Investigations dive deep into high level market and cultural issues, going beyond simple analysis of single stocks

- Explainers break down the story behind the technology and trends you hear about most

- Television news, radio, and podcasts provide alternative ways to consume stock news

- Segmented newsletters, tv shows, radio stations, and podcasts mean you can consume only what interests you most

Top Features

- Podcast library

- Bloomberg TV streaming

- Terminal Lite tools for data analysis

- Market-moving exclusive interviews

- Global economics and markets coverage

Pricing

Bloomberg is available for free but you’ll only be able to read a few articles before you hit their paywall. Paid plans are available for up to $420 per year. Text newsletters and Businessweek print editions are available for a fee.

3. Wall Street Journal (WSJ): Best for Corporate Analysis

Like Bloomberg, the Wall Street Journal is a respected global financial news publication. You’ll find insights into corporate strategy, market development, political influence, and more.

In addition to the latest market and stock news, you will also find sections dedicated to art, lifestyle, real estate, personal finance, style, sports, and health.

If you prefer to listen, rather than read, you’ll enjoy WSJ’s audio articles and podcasts. You’ll also find some video news opportunities, although far less comprehensive than those offered by Bloomberg TV.

Advantages

- Provides context beyond headlines for more rational decision-making

- Emphasizes long-term trends over short-term fluctuations

- Maintains professional journalism standards with fact-checking

Top Features

- WSJ Pro premium tier for institutional investors

- Exclusive data and analysis tools

- Expert opinion columns from market leaders

- Investigative reporting on corporate developments

- Market data center with customizable charts

Pricing

You can access Wall Street Journal for free, but to avoid being limited in your news consumption and to access premium articles, you will need to pay $55 billed every 4 months (or $165/year). Print subscriptions can cost up to $65 billed every 4 months or $195 annually.

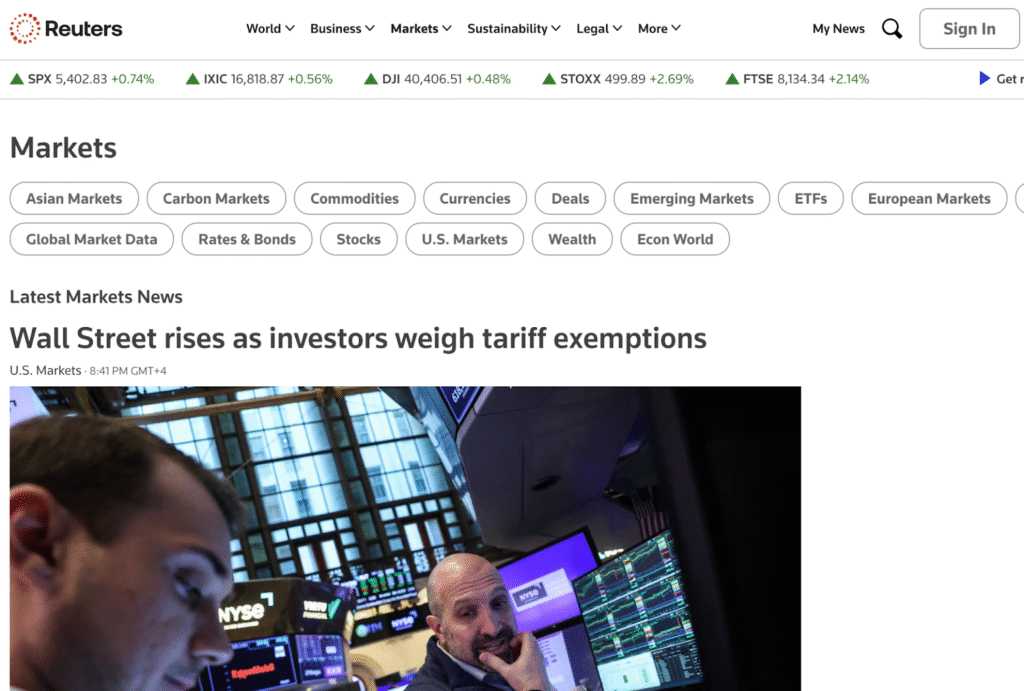

4. Reuters: Best for Unbiased Global Coverage

Reuters delivers global news on various topics. Its contributions are provided by over 2600 journalists operating in 200 locations worldwide. If you’re after expertise in international economic markets or geopolitical coverage from journalists on the ground, then Reuters may be the stock news source for you.

Verticals covered by Reuters include:

- Tech

- Legal

- World

- Markets

- Business

- Sustainability

- Investigations

If you’re seeking broader lifestyle topics for insights into the trends and events shaping broader culture, you’ll also find sports, lifestyle, and science news.

Like Bloomberg, Reuters’ graphics section provides helpful charts, graphs, and visual storytelling to explain complex data and topics that you may not be intimately familiar with – helping you gain insights you might otherwise miss.

Advantages

- Balanced presentation reduces emotional decision triggers

- Global perspective helps avoid home-market bias

- Regulatory focus supports understanding of structural market changes

Top Features

- Podcast

- Mobile app

- Video content

- Segmented newsletters

Pricing

Reuters provides you with generous free tier access, but if you want to unlock unlimited access, the Reuters news app, market data, and the subscriber-only newsletter – it will cost you $45 per year.

5. Financial Times (FT): Best for Economic Policy Analysis

The Financial Times diligently covers global markets and politics to keep you informed about all the latest and biggest events.

When it comes to markets data, you’ll be able to access the latest news across a range of asset types, including:

- ETFs

- Crypto

- Equities

- Currencies

- Commodities

Premium subscribers can access Financial Times’ flagship “LEX” column, which has been published daily since 1945. If you opt for a paid plan, you’ll discover deep dives into topics like how tariffs will impact botox and other pharmaceuticals, insights into global banking systems and (in)stability, the latest on the AI race, and more.

If your investment strategy involves seeking out environmentally friendly stocks or leveraging the impact of changing weather patterns, the Financial Times’ “Climate Capital” will be a go-to news source for you. You’ll learn about carbon levies, shareholder backlash due to green strategy walkbacks, retreating arctic sea ice’s impact on shipping routes, and more.

Advantages

- Analytical rather than reactive content approach

- Strong emphasis on macroeconomic factors affecting markets

- European perspective balances US-centric financial media

Top Features

- Lex Column for equity and M&A analysis

- Climate Capital for ESG investing trends

- Economic policy deep dives

- Global markets coverage with European expertise

- Premium data visualization tools

Pricing

Like all stock news platforms in this article, you’ll be able to access some articles and features for free. But full feature and news article access requires you subscribe to a paid plan. Digital access costs up to $75/month, and print editions can be had for $300/year.

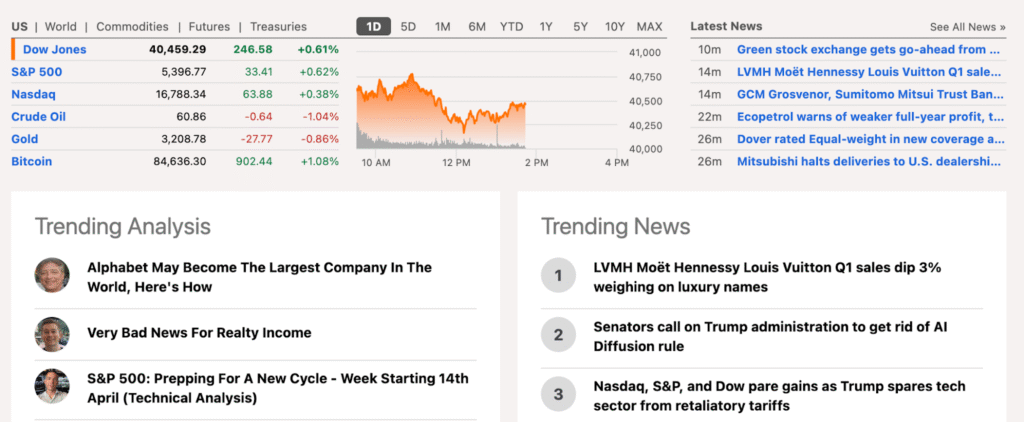

6. Yahoo Finance: Best Free Stock News Platform

One strong advantage of Yahoo Finance is that it doesn’t only provide the latest stock and market news. Yahoo Finance is also a fully-fledged stock research platform (depending on your subscription plan) If you upgrade your account, you will also be able to access helpful stock research & analysis tools.

Markets covered include:

- ETFs

- Crypto

- Stocks

- Futures

- Options

- Currencies

- World Indices

- Private companies

Stock analysis tools available to you on a paid plan include charting and technical indicators, analyst estimates, up to 40 years of historical stock data, Morningstar stock ratings, and more.

Advantages

- Not only news articles but also structured stock price and fundamentals data

- Extensive free features

Top Features

- Advanced charting with multiple technical indicators

- Screeners for stocks, ETFs, and mutual funds

- Customizable watchlists

- Portfolio integration

Pricing

Yahoo Finance offers comprehensive free access to most features. The Yahoo Finance Gold subscription (which gives access to stock research & analysis features for active trading in stocks, options, crypto, and more) costs $49.95/month.

7. Barrons: Best for Institutional-Grade Research

Barron’s weekly financial publication focuses on thorough in-depth analysis sought out by even institutional investors.

If you’re seeking support in uncovering top stocks or managing your portfolio, you will be able to use the publication’s annual Advisor Rankings to pick a top financial advisor.

Barrons’ lists and rankings go well beyond ranking financial advisors – you’ll also be able to quickly discover vetted top sustainable companies, robo advisors, annuities, online brokers, and more.

With Barrons you’ll be up to date on all the important news about:

- ETFs

- Bonds

- Stocks

- Futures

- Currencies

- Mutual funds

Advantages

- Emphasis on fundamental analysis over technical indicators

- Focus on long-term value rather than short-term price action

- Perspectives from professional money managers

Top Features

- Custom stock screeners with valuation metrics

- Annual Advisor Rankings

- Market Week section with forward-looking analysis

- Asset allocation models

- Roundtable discussions with top investors

Pricing

You’ll be able to access Barron’s articles for free. But if you want unlimited access and exclusive offers from Barrons’ The Journal Collection, it will cost you $240 per year. You can also bundle Barron’s with a MarketWatch subscription for $299 per year – or add to that bundle with a WSJ and Investor’s Business Daily Digital subscription for $715 per year.

Finding Your Stock News Source: Recommendations Based on Investing Style

The best stock news source for you depends entirely on your investment approach, research needs, and content preferences.

If you focus on long-term value and business fundamentals then your best options are Wall Street Journal or Barrons. Both news platforms provide deep analysis of business strategy & models and competitive landscapes. Their emphasis is strongly on long-term trends over daily price movements.

If you make frequent trades based on market movements then Bloomberg (with its range of content options and daily TV series) or Yahoo Finance (with its comprehensive stock price and fundamentals data) should suit your needs well.

Reuters, with its thousands of journalists across hundreds of global locations, will suit your style if you invest globally and value on-the-ground expertise from local reporters.

Lastly, if it’s diverse perspectives from real analysts you seek, rather than polished articles written by professional finance journalists, then Seeking Alpha’s ‘Analytics’ section contains all you need to get the bull case, bear case, and everything in between.

But remember, the wisest approach to investing combines three key elements:

- Selective news consumption: Choose a few high-quality news sources.

- Know your strategy: Don’t try to stay up to date with everything everywhere. Know your industries of interest or investment strategy and tailor your news consumption to feed into that.

- Fundamental validation: Verify news claims against actual fundamental stock data using stock research tools like Gainify.

As Philip Fisher (pioneer of growth investment strategy and author of Common Stocks and Uncommon Profits) said – “The stock market is filled with individuals who know the price of everything, but the value of nothing.” Your edge is in finding a stock news app and a stock research tool that helps you understand value, not just refresh price charts.

Frequently Asked Questions

Which stock news app provides the fastest breaking news alerts?

Bloomberg may deliver faster alerts for major market-moving news due to its direct connections to newsrooms, live TV, and market data feeds. However, the fastest alerts aren’t always the most reliable. Barrons also features live and developing stories on its homepage.

Is a paid subscription worth it for stock news, or are free sources sufficient?

Free sources like Yahoo Finance provide adequate coverage for casual investors. However, institutional investors often benefit from the premium features, deeper analysis, and specialized insights found in paid subscriptions like Bloomberg or Barron’s.

How can I tell if a stock news source is reliable?

Look for transparency about sources, clear distinction between news and opinion, analysis backed by verifiable data, and disclosure of potential conflicts of interest. Publications with established editorial standards like Wall Street Journal, Financial Times, and Reuters maintain strict fact-checking processes. Other sources such as Twitter (X) Instagram accounts promoting investment opportunities may not.

Should I use multiple stock news sources or focus on just one?

It’s up to you. But following too many sources can lead to information overload and decision paralysis. Instead of spending all day reading news about dozens of stocks – read until you find a stock you’re interested in, and then deep dive into that stock’s fundamentals and outlook using Gainify. That way you’ll engage your opportunity seeking and analytical capabilities together.

How can I avoid making emotional decisions based on market news?

A reflection period between consuming news and taking action – even just 30 minutes – allows your analytical brain systems to engage rather than reacting emotionally. Seek out alternative opinions, review the bull and bear cases for a stock, and check company fundamentals using Gainify.

What’s the relationship between financial news and stock price movements?

Markets may overreact to breaking news in the short term, creating opportunities for patient investors who focus on fundamentals. In other cases, what is news to you may not be news to the savvy investors on Wall Street, and it may already be priced into the market.